“Prior to utilizing Centric’s services, the team relied on manual markdowns—a very tedious process that didn’t give us the ability to scale quickly.”

Sarah Gourley, Director, Brand Portfolio, Merchandise Strategy & Insights, Neiman Marcus Group describes the situation prior to Centric Market Intelligence™. The process was manual and didn’t optimize the information that allowed the company to make data-based decisions. Today, Centric Market Intelligence is used across the company including pricing, merchandising, assortment planning, marketing and e-comm teams among others. “The tool lets us get competitive data more efficiently.”

Neiman Marcus

Neiman Marcus is a Dallas-based luxury retailer, providing customers access to exclusive and emerging brands, anticipatory service, and unique experiences since 1907. Each day, Neiman Marcus connects with customers worldwide while delighting them with exceptional experiences across a 36-store presence in the U.S., one of the largest U.S. e-commerce luxury platforms, and industry-leading remote selling and personalization technology. From delectable dining and indulgent beauty services to bespoke experiences and exclusive products, there is something for everyone.

Neiman Marcus is part of Neiman Marcus Group. As one of the largest multi-brand luxury retailers in the U.S., with the world’s most desirable brand partners, NMG delivers exceptional products and intelligent services, enabled by investments in digital, data and technology. Through the expertise of the company’s 10,000+ associates, it delivers and scales a personalized luxury experience across its integrated retail model- in-store, eCommerce, and remote selling. In addition to Neiman Marcus, NMG operates two Bergdorf Goodman stores and five Last Call stores.

Leveling Up in Functionality

Neiman Marcus was looking to replace their competitive pricing tool. “We did RFPs with four or five other providers. Not all of them were apples to apples, but Centric Market Intelligence impressed us with its capabilities and usability. It was by far the most user-friendly interface—intuitive, visual, something our merchants and teams could really sink their teeth into.” In addition to understanding what was going on in the marketplace on like-for-like products, Gourley says, “It gave us a whole slew of visibility; how our assortment compared to competitors from a brand standpoint classification. That was a really big feature, and the search and trend and promotion visibility was a real bonus.” In the end, the functionality, the Centric team and the full package that Centric Market Intelligence was able to offer, won the Neiman Marcus business.

Onboarding

To get started, the company tested just a few categories with a couple of competitors. After getting a feel for it, the user-friendliness of the software allowed for a quick expansion to all categories and more competitors. Gourley says, “Centric Market Intelligence is a very intuitive tool. It’s easy to use. One of the things that it offers is a lot of broad analysis. We have continued to work on use cases with the Centric team so we can then give our teams specific instances in which to leverage this tool. Over time, more and more users have jumped onboard.”

Gourley states, “One of the things that’s made Centric Market Intelligence such a great partner is that we’ll have an idea and ask them, ‘can I get this type of information?’ and not only will the Centric team be available to answer questions, but they’ll go above and beyond. I can’t tell you how many times that they’ve said, ‘let me play with this,’ and by the end of the day I’ll get a workbook that gets me started!”

Turnkey

Jordan Pious, VP, Neiman Marcus Performance & Growth came in after Centric Market Intelligence had been implemented. He says, “I was thrilled to see that we had made the investment in Centric Market Intelligence, because I see Centric Market Intelligence as a useful tool to streamline how we view and operate the business as it relates to our positioning competitively—from an assortment standpoint, a pricing standpoint, finding those whitespace opportunities, and really knowing when and how to react to business trends.”

Pricing Competitiveness

Pious explains the role of his department. “We’re the connector across the business, really, in terms of merchandising, marketing, stores, digital, analytics, and making sure that we’re crafting strategies that drive performance and growth for the Neiman Marcus brand. To do that effectively as a retailer, we sell product… there is a focus on merchandising because we know we need to have the right product in the right place at the right time. And I’ll add another layer: at the right price.” And therein lies the key. Pious says that it must be done competitively or “we’ll lose sales, we’ll lose market share, we’ll lose credibility with our customers.”

As they craft those strategies to remain competitive, Pious’ team is focused on positioning Neiman Marcus uniquely, to understand the nuances, the differences versus some of their core competitors. “We look at that from an assortment standpoint, from a pricing standpoint, among other things, how they’re marketing to our customers, what are some of the features and benefits of their different channel plays?” says Pious.

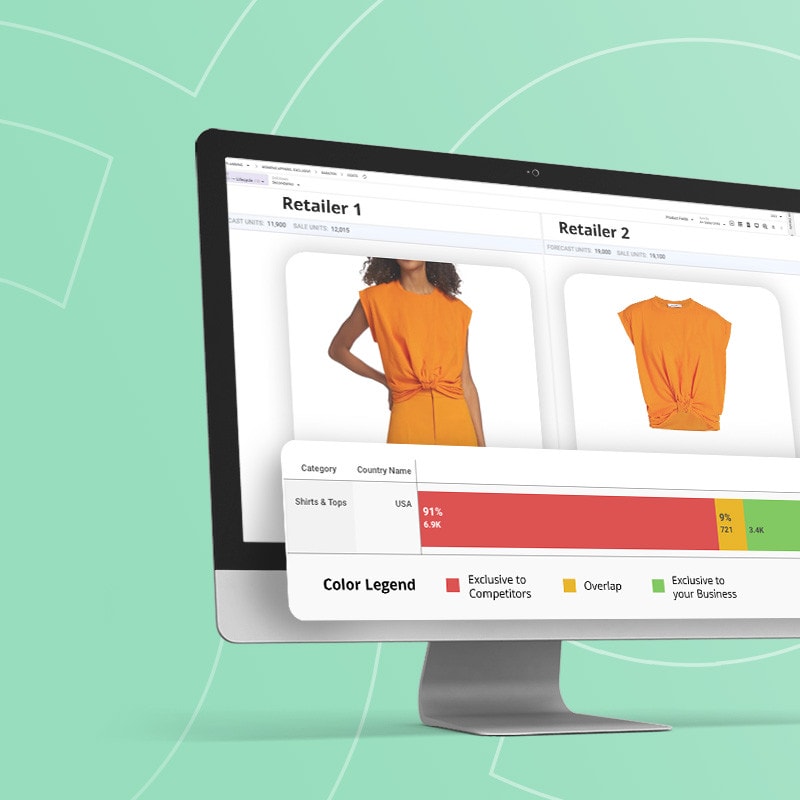

Gourley talks about how they leverage Product Matching, an ML-driven module of Centric Market Intelligence to effectively match exact products across retailers. “When we get into our peak discounting season, we will often look at like-for-like product comparing ourselves to our key competitors to understand how our pricing or discounting differs. A power user on our team pulls that information and then shares it out more globally. We can also augment it with our internal data to analyze product performance and determine the reasons behind the success or lackluster sales.”

Pious gets into the details, “With Product Matching you’re able to view at an item level, at a SKU level, the like-for-like items, you can export that view in Excel, you can literally tie in your style ID, send it off to your pricing team, they execute the price changes to match, and overnight, boom, you’re competitive. I mean, it doesn’t get much easier than that.”

More than Pricing

For Neiman Marcus, the tool is so much more than just pricing in terms of the breadth of the offering and being able to pull in specific competitors to view. It informs buying by identifying trends. For example, the team can view how many styles of espadrilles Neiman Marcus has compared to their competitors. They can then supplement that information with market research data and realize ‘oh, espadrilles are hot.’ Once they know that, they can then dig deeper; which retailers, which department stores and was this anticipated? Then cross-check it with Google search information and feed that into their buying process to inform the breadth of their buys.

Gourley says, “Our e-commerce team tracks whether a category is underperforming and when they see that, it triggers them to look more closely. What are the contributing factors? Assortment, price points, traffic. Is this category down amongst all competitors or just at Neiman Marcus?”

Assortment planning is another user group. They’ll evaluate whether overlap with competitors is warranted: is it because it’s the best product or would more exclusivity help in this case? Having a good grasp of how much overlap and where there might be opportunities is a solid starting point from which to build out an assortment for a brand. Gourley says,

The tool also lends insight into classifications like, how heavily penetrated in dresses are we compared to the competition? What about suiting; are we missing an opportunity there? Is that something that we should be going after? It opens up questions and conversations for our teams to either validate the assortment we're building or have us think a little bit differently, perhaps.”

One of Gourley’s favorite ways to use Centric Market Intelligence is to determine ‘size brokenness.’ She explains, “If a particular brand/style is unavailable in certain sizes, by inference it means our competitors are sold out. The full range of product is no longer available. This is an opportunity to look into if we have the same products, why ours aren’t sold out.”

Or if they are, and I can see that it affects all of these silhouettes in this color family, that’s an opportunity for us to go chase.” Meaning that she can then go to the brand and ask to augment their assortment, working in-season to get more of what is doing well or perhaps adjust those that aren’t and try something different. “That’s a great way to leverage the tool.”

A Tool for All

Pious reiterates how user-friendly Centric Market Intelligence is. “I think in many ways you guys have dumbed it down—and I mean this in the most complimentary way possible—it is approachable in a way that the organization is able to leverage and digest the insights that come out of Centric Market Intelligence.” He goes on to say that pricing itself has always been a bit of a black box conundrum for so many retailers. Adding to that, players like Amazon who have dynamic pricing that is constantly changing, makes it very difficult to keep on top of it all.

Pious does concede that “at the end of the day, core retail is still operating on a reasonable timeline in terms of when we have full price selling, when we go to markdowns, when we run big promotions. But so many companies don’t invest in the tools to be able to be competitive and to react quickly to some of these changes. Centric Market Intelligence allows you to do that, in the easiest, most digestible way possible.”

The Best Team

Both Gourley and Pious are effusive in their praise for the Centric Market Intelligence team in how responsive, knowledgeable and receptive they are.

Gourley says, “The thing that sets Centric Market Intelligence apart from a lot of the other third-party providers that are out there is the team. We have had such an incredible experience and such great responsiveness from them. And frankly, that to me starts with our account lead, because she’s the one that we work with all the time. But it’s her entire team. It’s the tech team, the ability for them to grow the tool and enhance it in response to our business requests and needs is by far one of the things that makes it better than others that I’ve seen.”

Pious enthuses, “From day one, conversation one, the partnership approach, the thoughtful, incredibly smart and collaborative nature of the Centric Market Intelligence team opened up so many doors. Of course, the platform itself has all of the bells and whistles that we need, but that is only part of the equation. The people really build that trust and credibility. Our account lead is just a superstar! She understands the Neiman Marcus business opportunities that we’re exploring, and she understands our business model to be able to suggest ways for Neiman Marcus to position ourselves better, competitively. The team helps us find ways to leverage this platform even more and keeps on teaching us ways to get more value out of it.”

New to Centric PLM? Learn more

What is Centric Pricing & Inventory? Learn more

What is Centric Market Intelligence? Learn more

Centric Visual Boards Learn more