How Retail Brands Can Perfect Competitive Pricing Intelligence

For retail businesses, pricing is a strategic lever that can be used to define profitability, customer perceptions and market position.

Where some pricing strategies are based on costs of goods or financial targets, there’s also an approach that enables brands to benchmark their industry and competing brands—that’s competitive pricing intelligence.

Using real-time pricing data and AI-based technologies, today’s brands can craft dynamic strategies that allow them to compete more efficiently with other businesses while meeting—and hopefully, exceeding—the growing demands of modern, informed consumers.

In this article, we’ll explore the foundation of competitive pricing intelligence and how your brand can harness the power of real-time price tracking to better position your products in the market with data-driven decisions.

What Is Competitive Pricing Intelligence?

Competitive pricing intelligence is the process of researching, gathering, analyzing and acting on real-time pricing data taken from competing organizations. This can include how your competition typically prices their products or services and what tactics and techniques they use for promotions, positioning and overall market fit.

Although competitive pricing intelligence tracks the actual prices of goods, the “intelligence” part of the process goes beyond simply gathering data. Instead, it scales to creating your own pricing strategies that are competitive in the marketplace but also reflect your brand’s positioning and financial targets.

An effective pricing strategy takes into consideration the financial side of product development, but also enables brands to understand why a competing brand or product is positioned the way it is.

Often, brands use the terms “price monitoring,” “dynamic pricing” and related concepts to refer to price strategies, but competitive pricing intelligence is a broader approach that integrates many data points and streams into pricing decisions.

Most importantly, competitive pricing intelligence takes countless data points and channels and combines them into one easy-to-digest—and actionable—platform.

When implemented effectively, pricing intelligence enables brands to:

- Benchmark against their key competitors

- Recognize market shifts and trends quickly and easily

- Create real-time demand-driven strategies

- Avoid fruitless price wars and unprofitable competition

- Optimize price strategies across various channels

Taken at face value, prices may seem straightforward, but pricing intelligence gets to the underlying causes and concepts that make price trends what they are—and how brands can leverage that valuable data.

What Does Pricing Intelligence Look Like in the Real World?

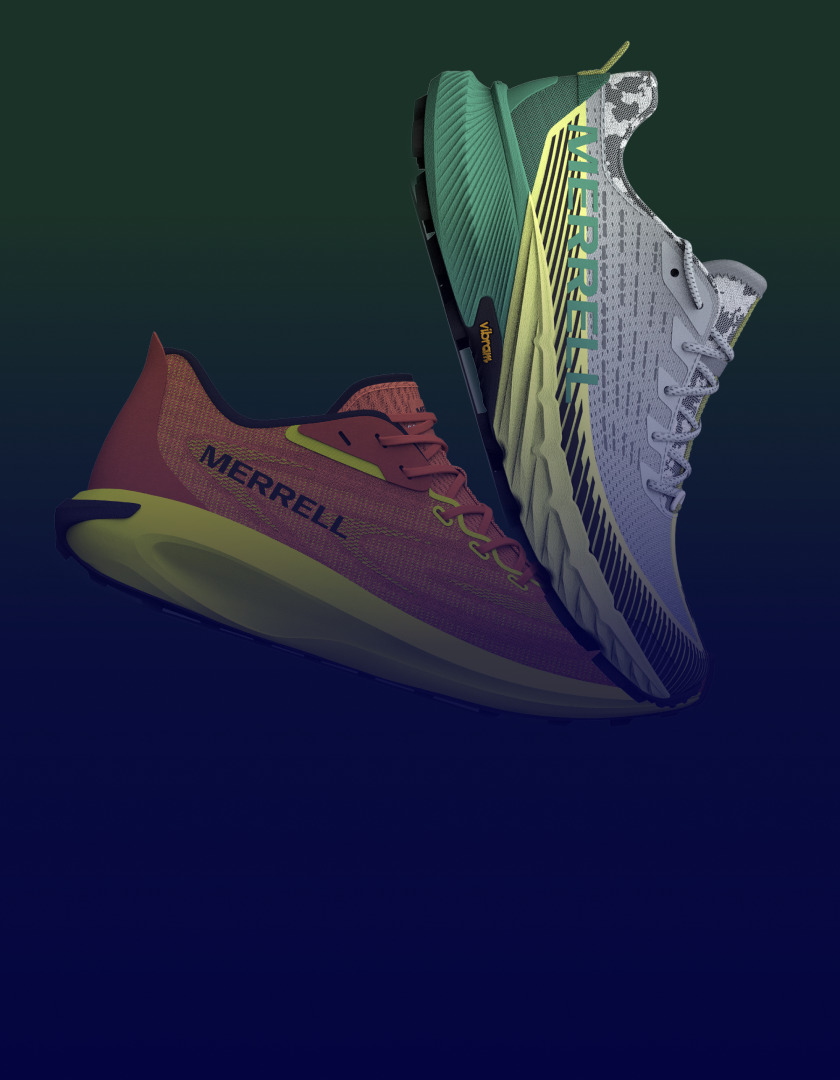

Picture a fashion and apparel brand launching a new line of activewear. With an effective competitive pricing intelligence approach, the brand can:

- Identify price gaps or similarities with competing activewear brands

- Detect pricing inconsistencies across channels and platforms, like Amazon and owned websites

- Find products that can sustain price promotions without becoming unprofitable

- Discover where competing brands are promoting or discounting products

With competitor pricing intelligence—typically hosted on a real-time, cloud-based platform—brands can optimize their approach to pricing by having lots of competitor data to analyze and act upon.

This makes it easier for brands to set prices that protect their margins, their market position and their marketplace competitiveness.

Why Retailers Can’t Afford to Ignore Pricing Intelligence

Armed with more knowledge and tools than ever before, today’s consumers are well-equipped to deal with a competitive marketplace in any industry.

What does that mean for brands? Pricing has never been more important. A 2023 ESW report found that nearly a quarter of shoppers research products online before making an in-store purchase and part of that research process typically focuses on pricing and promotions.

A 2023 study from Tulane University professor Chris Hydock found that different pricing strategies—from offering consistently low prices to promoting frequent discounts on higher priced goods—can target different consumers who are more focused on “taste” and those focused on “quality benefits,” for example.

Competitor pricing intelligence is critical for:

- Engaging with omnichannel shoppers: consumers research and purchase on more platforms than ever, which means there are more channels to monitor than ever before.

- Maintaining healthy product margins: striking a balance between staying competitive while scaling profitability is difficult without a data-driven foundation.

- Reacting to market volatility and trends: supply chain disruptions and changes in consumer wants can quickly spread to competing prices, which makes real-time monitoring crucial to staying on top of your market.

Pricing intelligence enables brands to shift from reactive to proactive by using real-time data to create pricing strategies that are flexible, agile and profitable.

Crafting a Data-driven Competitive Pricing Strategy

The right pricing strategy collects pricing data, to be sure, but it also focuses on actionable insights.

Combining financial and operational goals with multiple pricing data streams offers a high-level look into a pricing model that adapts in real time. Here’s how today’s leading retail brands are building data-focused pricing intelligence strategies.

Clear Goals

The retailers winning today start with clear objectives—and the right questions.

Are you defending market share, protecting margins on key value items, or positioning against channel disruptors like Amazon? Your goals determine everything from which competitors deserve your attention to how frequently you need fresh data.

Smart Competitive Focus

Not all competition is created equal and not all competitors are worth your attention. Focus on direct competitors and emerging threats that actually impact your bottom line.

If it’s easier, you can segment competitor monitoring by category—tracking different players for different product lines prevents data overload while still capturing meaningful market shifts.

Automate Data Collection

Gone are the days of manual price checks and spreadsheet chaos.

Modern competitive pricing systems deliver real-time insights through:

- Automated web scraping and API integrations

- Partner feeds and retail analytics tools

- Internal sales feedback and promotional calendars

- Historical win/loss reporting

The key is connecting external pricing data with your internal cost, margin and inventory information. Seeing competitor moves is useful, but understanding their profit implications is tangible and powerful.

Turn Analysis Into Action

Without putting it into real-world use, competitive pricing intelligence risks being useful only on paper.

Use dashboards to spot price gaps, identify margin leakage and detect promotional patterns across channels and regions. When you can model scenarios quickly and understand impact before making changes, pricing becomes strategic rather than reactive.

With data and a plan of action, you can create feedback loops that connect pricing insights across merchandising, marketing and planning teams. When everyone works from the same data source, decisions happen faster and competitive pricing intelligence transforms from guesswork into profit driver.

Automating Competitive Pricing Intelligence

Pricing intelligence is only helpful when it allows you to act on your own prices before it’s too late, which means technology and automation are the foundation of any effective real-time strategy.

Manual pricing workflows—think spreadsheet-based tracking, scattered feedback loops, reactive promotions—don’t cut it anymore. Automation turns pricing from a bottleneck into a competitive advantage.

In e-commerce, prices can change hourly—or even minute by minute. Human teams can’t monitor dozens of competitors across multiple channels, regions and categories 24/7.

Technology fills this automation gap with:

- Continuous price monitoring across marketplaces

- Automated alerts for competitive price changes or promotions

- Schedule-based or rules-based pricing updates

- Well-structured data that feeds AI-powered systems

At the heart of this automation is seamless integration, which means that pricing—as part of a larger product lifecycle management strategy—is updated in real-time for teams and stakeholders from product development to distribution and beyond.

Unifying Pricing Data

Too often, pricing data lives in silos. Marketing may have insights on campaign performance, while planning teams manage spreadsheets for markdowns and sourcing negotiates with outdated cost assumptions.

A proactive competitive pricing intelligence plan eliminates these silos by creating one actionable source of truth—where pricing data, product details, cost structures and inventory positions all connect.

Competitive Pricing Intelligence Obstacles

Even with the best tools, competitive pricing intelligence can fall short if misused. The most successful retailers know this goes beyond collecting data to how you interpret and act on it. Here are key obstacles to watch out for while building a pricing intelligence plan.

- Overreacting to competitor discounts: Not every price drop deserves a match. Without context—such as inventory clearance or regional strategy—blindly copying competitor moves can erode margin unnecessarily.

- Neglecting customer perception of value: Pricing too low can hurt your brand’s positioning just as much as pricing too high. Smart retailers balance market benchmarks with perceived value and product quality.

- Siloed pricing workflows: When pricing lives only with one team, critical insights get lost. Without coordination across merchandising, planning and marketing, response times lag—and opportunities are missed.

- Lack of historical benchmarking: Making decisions based solely on today’s data ignores key trends. A strong pricing intelligence strategy includes historical patterns to forecast with confidence.

- Overcomplicating tech adoption: Tools that require steep learning curves often get abandoned. Choose solutions, such as Centric Market Intelligence™, that integrate easily and deliver fast, actionable insights.

Avoiding these mistakes ensures your pricing intelligence investment drives measurable results: improved agility, stronger margins and smarter decision-making from end to end.

Building a Pricing Framework with Centric Market Intelligence

Launching a competitive pricing intelligence strategy doesn’t have to be overwhelming. The key is starting with clear goals and the right foundation. With Centric Market Intelligence, retailers can quickly align pricing decisions with market dynamics, internal objectives and margin performance.

Here’s how to start:

- Align on strategic goals: Define what pricing success looks like—protecting margins, improving market share, or optimizing promotions—so every insight leads to action.

- Prioritize key competitors and categories: Focus on the players and product areas that have the most impact on your brand’s performance.

- Automate competitive data collection: Eliminate guesswork and manual effort by capturing verified pricing data from across the digital shelf—daily, at scale.

- Centralize pricing insights: Integrate competitor pricing, product details and inventory metrics into a unified dashboard that supports cross-functional planning and execution.

- Turn insights into workflows: Set pricing rules, trigger alerts and automate adjustments directly from within Centric’s platform—ensuring consistency and speed.

With Centric Market Intelligence, teams can go from reactive pricing decisions to proactive, data-driven strategies—quickly, confidently and collaboratively.

Transform Pricing Intelligence into a Competitive Advantage

Competitive pricing intelligence is a growth enabler for retail brands looking to thrive in the economic uncertainties and disruptions of today’s markets.

For brands like Everlane, for example, competitor intelligence is a game-changing part of their pricing workflows.

“When we’re asked to validate the pricing architecture of our linen business, we can pull that information very easily and quickly,” says Kelly Wang, Director of Merchandising at Everlane. “We can generate a report to share with the exec team to show why we’ve priced linen in between competitor A and competitor B. And we’re confident that this is the right pricing range.”

From understanding your competitors’ baseline pricing strategies to moving quickly with market changes, Centric Market Intelligence enables organizations a 360° view of their market for maximum price data and visibility.