Report

Cosmetics and Personal Care Supplements at Highest Level Nationwide, Centric Market Intelligence Report Reveals

Across the UK, the supplement market is exponentially breaking consumer record demands. The range of products available to purchase across hair, beauty and personal care markets have expanded significantly, with 57 times more options as of Q4 2023, than there were in Q1 2021.

This is according to a newly produced Supplement Market Report by Centric Market Intelligence™, who extracted data from leading ecommerce brands nationwide, including Boots, Sephora and Space NK, utilising competitor benchmarking and pricing intelligence. Having mapped extensive data over the last three years, Centric Market Intelligence can reveal a pricing pressure among retailers has been created, providing customers with more options at various prices.

Although demand is up, data highlights that by the end of 2023, prices had fallen across the entire hair, beauty and personal care supplements market by 25%, compared to the beginning of 2021. Discounts available to consumers have decreased year-on-year (-29%), as a result of more products on the market and pricing pressures amongst retailers.

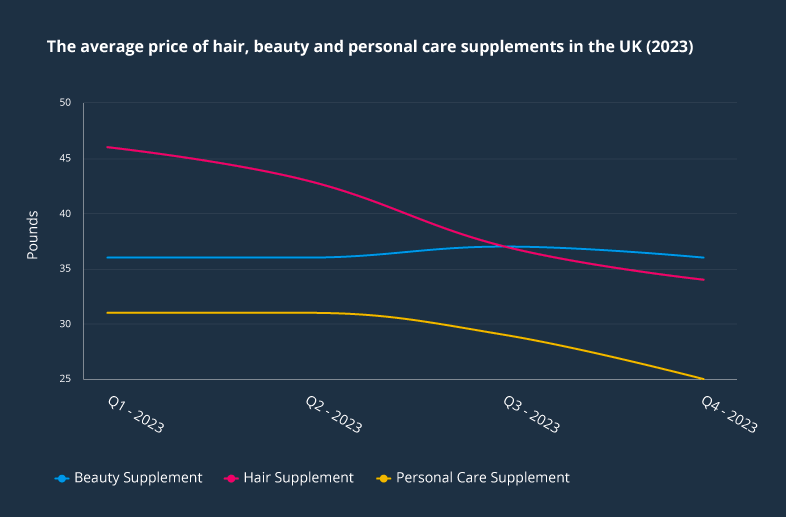

2023 UK supplement trends

Looking solely at retail price data for the average original price point of supplements across hair, beauty and personal care, prices have dipped by 18%, showcasing the competitive nature of the market. 2023 reigned supreme as the cheapest, with an average cost per product of £30.12, compared to 2021, where prices were the most expensive at £31.24.

Key takeaways include:

- The average number of products available to purchase was at its highest in 2023; 3 times higher by the end of December, compared to the beginning of the year.

- Hair supplements were the most expensive category, priced at £39.90 on average, however have dropped by 26% throughout the year.

- The cost of beauty supplements remained relatively steady throughout the year, increasing by 1.54%.

- Personal care supplements cost consumers on average the least in 2023 (£28.90).

- The highest annual sold-out rate for supplements was 2023 (22%).

- Discounts provided by retailers to consumers across all supplement categories have fallen by 44% throughout the year, in light of price increases.

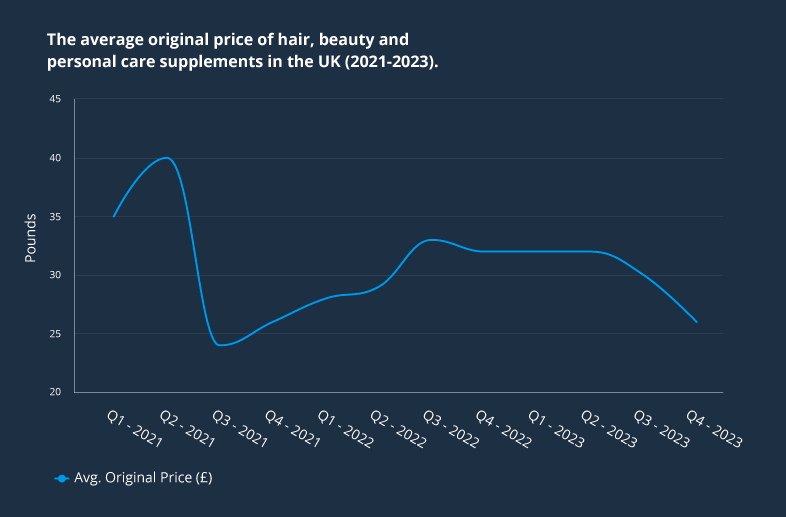

A deep dive into the UK supplement market: 2021-2023

Average Original Price

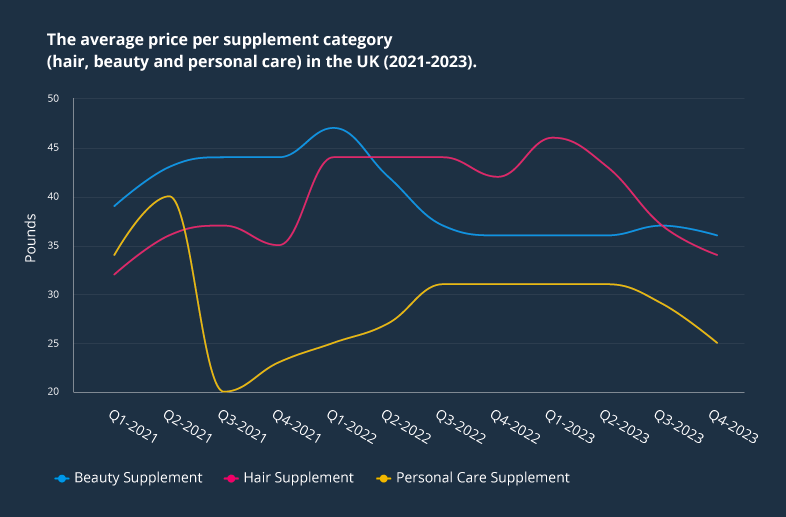

Between 2021-2023, the average consumer price of supplements was £30.60. Centric Market Intelligence took a closer look into the data revealing the following highlights across hair, beauty and or personal care supplements:

- By the end of 2023, prices had decreased by 25% across the supplements market, compared to the beginning of 2021.

- On average, beauty and hair supplements (£39.70) were both more expensive than personal care supplements (£28.80), another indication that a saturated market is developing, causing more competition than ever before.

- Beauty supplements fell in price by 14.5% in 2023 vs 2021.

- Average prices peaked in Q2 2021 (£40.40) and were at their lowest in Q3 2021 (£23.60).

- Hair supplement prices fluctuated, with prices at their highest level in Q1 2023 (£45.70).

- The average price for personal care supplements has remained somewhat consistent across the time period, dropping by just 1.1%.

Average Sold-Out Rates

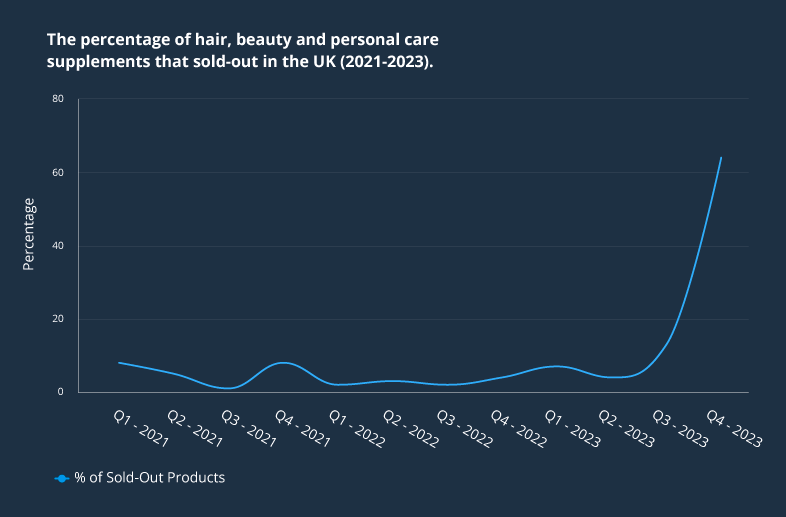

On average, 10% of products across all supplement categories sold-out. The highest annual rate was in 2023 at a staggering 22%.

- The lowest annual sold-out rate was in 2022 (3%).

- Q4 2023 experienced the highest sold-out rate (64%).

- The lowest quarter for sold-out rates was Q3 2021 (1%).

- The increased demand in supplements can be highlighted through the sold-out rate being 7x higher in Q4 2023 vs. Q1 2021.

Average Discount

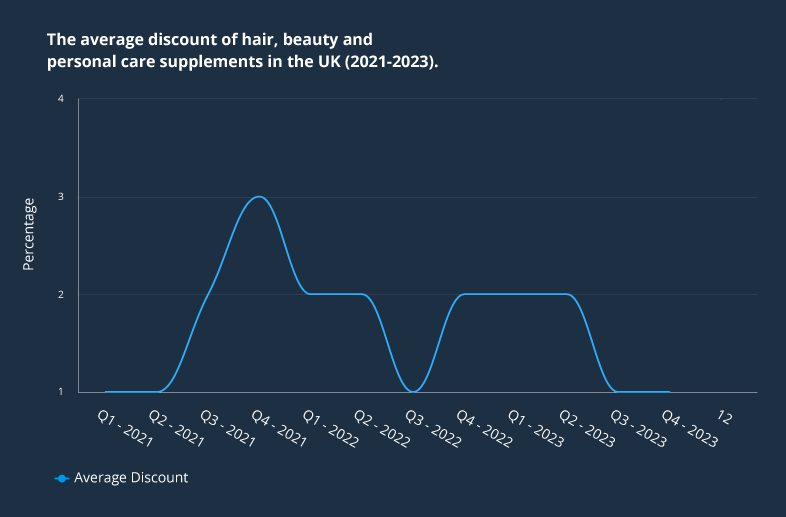

According to Centric Market Intelligence data, discount rates over three years’ were dictated by independent market pricing within each sector, highlighting an obvious pricing pressure among competitors.

- Across all three supplement sectors analysed, data reveals retailer discount incentives are on a downward trajectory, with 29% less supplements discounted.

- The average discount rate was just 2% over the last three years, as the beauty industry tends to be less directly promotional than its fashion counterparts.

The rise of supplements

Centric Market Intelligence analysed search data to understand consumer engagement year-on-year with the supplement market in the UK.

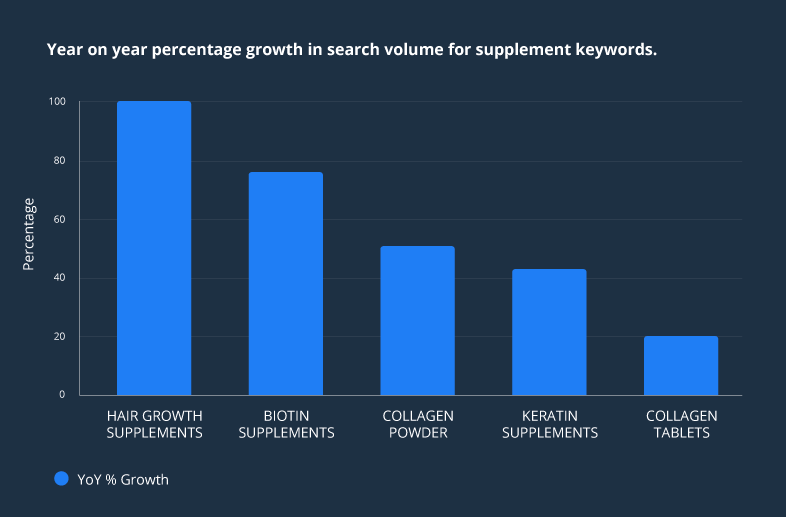

- “Hair growth supplements” had a 100% year-on-year increase in searches; a substantial surge in interest. Potentially attributed to consumers seeking products that can enhance and or support hair growth, as well as lifestyle changes and broader wellness trends.

- Biotin is associated with promoting healthy hair, so unsurprisingly, consumers seeking out vitamins and supplements to provide exactly that contributed to a 76% hike in searches for “biotin supplements”.

- In a bid to mitigate signs of ageing, consumers are looking at how they can incorporate collagen into their diet, with a 51% year-on-year increase in searches for “collagen powder”.

- “Keratin supplements”, another vital protein encouraging hair and nail growth, is up 43% in the UK YOY, aligning with general trends for personalised wellness plans.

- Albeit at a slower rate of growth to collagen powder, “collagen tablets” has seen a 20% rise in searches. Influenced by widespread on-the-go trends, shoppers are seeking alternative ways to introduce collagen into their diet more conveniently.

What’s clear is there’s a pressure from consumers who are actively reaching for supplements that specifically address their beauty and wellness needs, and for retailers to help bridge this gap between nutritional and personal care.

Centric Market Intelligence expert Elizabeth Shobert has provided a direct statement of analysis on what the UK supplement market has highlighted:

“Consumers are increasingly embracing the blurred line between beauty and health, looking for products like supplements that can enhance their overall health and wellness. We expect these trends to continue to pick up steam globally and we also expect to see increased innovation around product format, application and efficacy in the coming years.”

Methodology & Data

Centric Market Intelligence™ identifies market trends and competitive benchmarking by collating and analysing vast pricing data. To deliver this UK Supplement Market Report, 21 UK retail brands such as Selfridges, Space NK, Sephora, Boots, Clinique and Net-a-Porter were reviewed. Data extracted includes average product count, average original price, average discount price as a percentage and the sold-out product rate as a percentage.

Data collected from Q1 2021 to Q4 2023.