Has Beauty Discounting Behavior Changed?

After several years of strong expansion, the beauty industry is showing signs of slowing.

After several years of strong expansion, the beauty industry is showing signs of slowing. While growth had been running at about 7% annually during 2022-2024, recent forecasts suggest it will moderate to around 5-6% in the coming years. In key markets like North America, Australia, and China, demand for categories such as makeup and mass beauty has softened, and consumers are becoming more value-conscious, trading down, delaying purchases, and weighing price against perceived benefit. Inflationary pressures and market saturation are also adding headwinds, forcing brands to compete more fiercely for consumer attention. The result is a landscape where growth is less about riding the wave of momentum and more about careful positioning, sharper storytelling, and delivering real value.

Against that backdrop, it’s useful to consider how beauty compares to the wider retail landscape. In fashion, particularly in the U.S., deep discounting has become second nature, with some specialty retailers marking down products less than three weeks after they first appear online. Consumers have been trained to expect a deal, often sooner rather than later. Beauty, however, plays by a different set of rules. Even when sold alongside fashion, its promotional rhythm is distinct: straight discounts are rare, launches follow a slower and more carefully managed cadence, and side-by-side comparisons are far less relevant. In short, discounting in beauty hasn’t been nearly as aggressive. But is that starting to change?

Where Discounts Are Happening

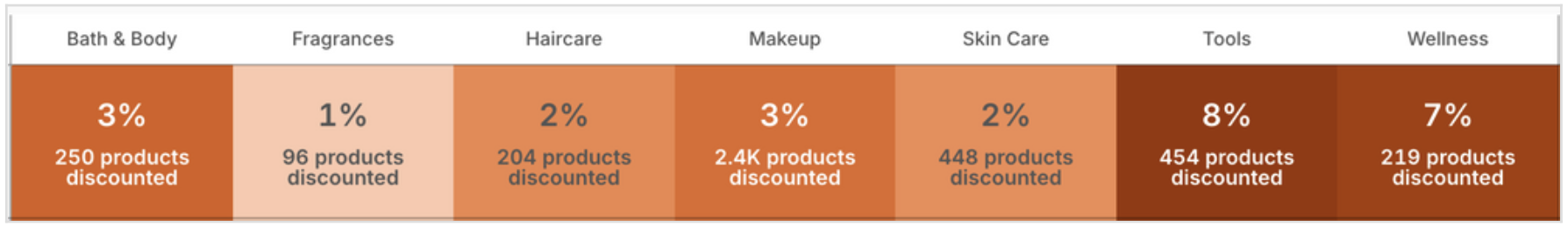

To explore this question, we looked closely at current discount activity across beauty. What we found is that only a small fraction of products are receiving direct markdowns. Across all categories, fewer than 10% of items are on any kind of sale right now (as of September 15, 2025). The categories with the highest promotional activity are Tools and Wellness, with 8% and 7% of their assortments on sale, respectively.

Current Average Discount Penetration Beauty

For comparison, we’ve included apparel at the same retailers to underscore a key point: beauty operates very differently from fashion.

Current Average Discount Penetration Selected Apparel Categories

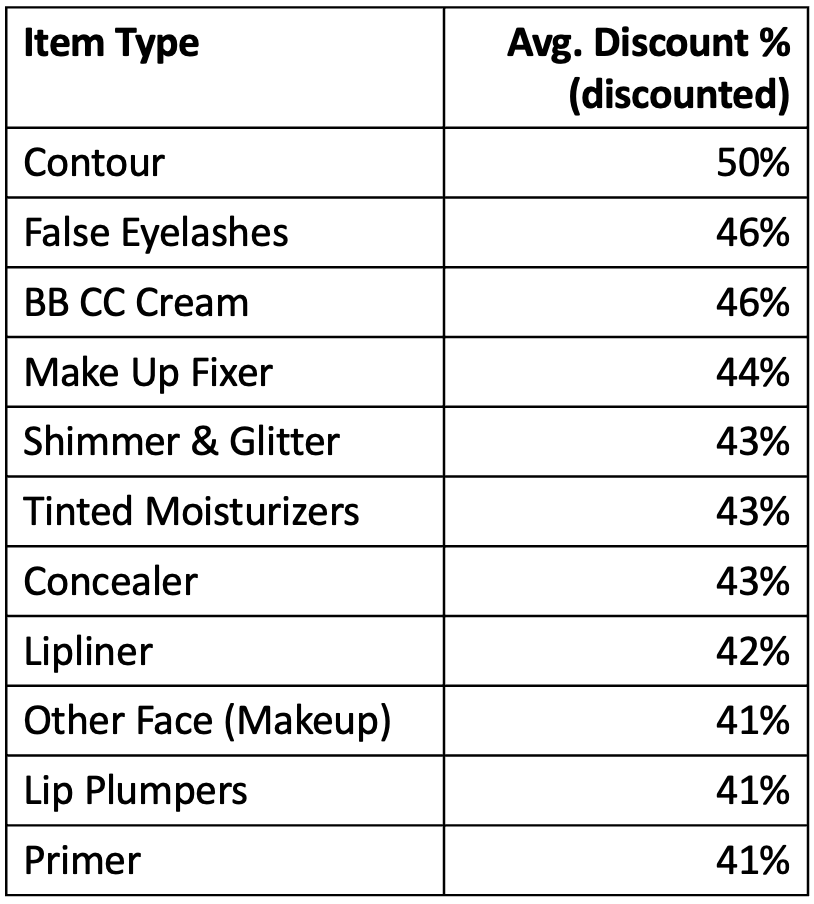

Even though discounts are generally sparse, a closer look at category-level activity reveals a clear pattern: once on sale, color cosmetics are far more likely to receive higher average discounts.

This likely reflects both competitive pressure in the color segment (lots more products for shoppers to choose from) and the fast-moving nature of these products, which drives retailers to use deeper discounts to stimulate trial and turnover.

Average Discount % Amongst Discounted Products: Color Cosmetics

Are Beauty Brands Are Adjusting Discounting Amidst Softness?

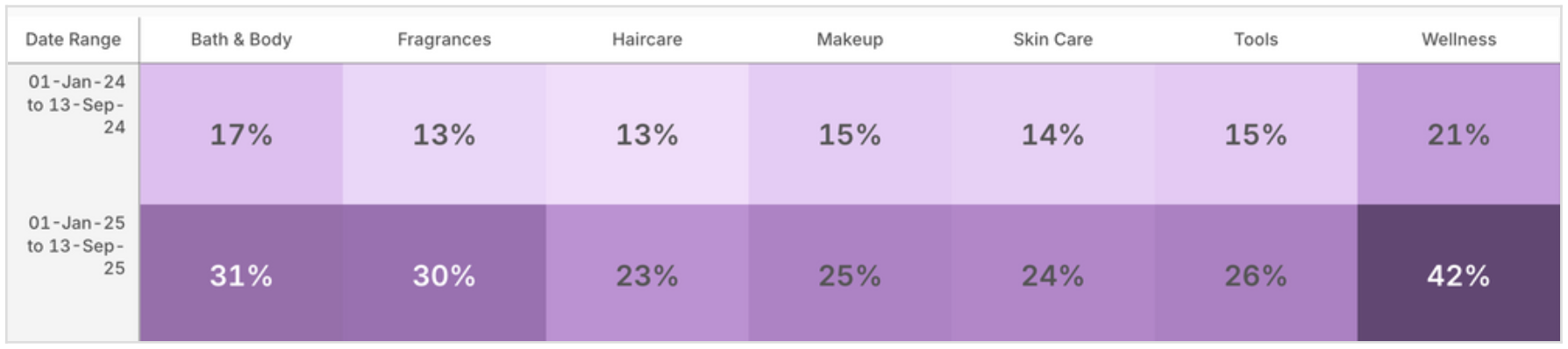

When we dig into YOY trends to see whether sector-wide softness is showing up in brand and retailer behavior, the data points to potentially early signs of weakness. While the increases are modest, we do consistently see a larger share of beauty products on sale this year versus the same time last year.

Average Discount Penetration: Compared YOY

The one exception is fragrance, the category widely regarded as the growth engine of beauty, which continues to hold firm. This divergence reinforces fragrance’s outsize role in propping up overall industry performance and suggests that other categories could soon be under mounting pressure to discount in order to maintain momentum. (For a deeper dive into the latest dynamics in fragrance, we recommend our recent in-depth report.)

Have Prices Shifted This Year?

Discounting is just one lever in a brand’s toolkit. Starting prices themselves act as powerful signals, conveying product efficacy, portfolio positioning, and competitive stance.

Median Original Prices: Compared YOY

A closer look at pricing reveals subtle but meaningful shifts. Median prices in fragrance are up 7%, while most other categories remain flat. Skincare, however, stands out with an 8% decline, falling from $53 to $49. Wellness beauty products like supplements also saw a slight decline in median price points. Whether driven by tariffs, changes in category mix, or softer demand, these shifts suggest that brands are actively recalibrating their pricing strategies.

So what? Pricing trends point to a sector in transition: fragrance brands are leaning into premiumization to reinforce growth, while skincare players may be testing more accessible entry points to protect share. For retailers and investors, these moves hint at where competitive battles and opportunities are most likely to emerge next.

How Shoppers Are Reacting

We’ve heard plenty of headlines about beauty giants and retailers beginning to feel the slowdown, but does the sold-out data tell the same story? A closer look suggests something more nuanced.

Sold Out Product %: Full Price Products

Across all major beauty categories, sold-out rates on full-price products are actually higher in 2025 than they were during the same timeframe in 2024. On the surface, this looks like a strong demand signal: consumers are still buying, and they’re doing so without waiting for markdowns. But another interpretation is just as plausible: retailers may have tightened up their buys, leading to leaner inventories and faster sell-outs.

Either way, the takeaway is clear: beauty’s resilience should not be underestimated. Even in the face of softening consumer sentiment, the category is still managing to move product at full price. The question is whether this strength reflects lasting consumer appetite or a short-term effect of conservative inventory management. The next few months will reveal whether beauty is truly weathering the storm, or if it’s simply running a little leaner before the pressure fully sets in.

Opportunities & Takeaways

What emerges from this deeper dive is a picture of an industry at a crossroads. Beauty has long distinguished itself from fashion with its measured cadence and resistance to widespread discounting, but subtle shifts in pricing strategies suggest the ground is beginning to move. Fragrance remains the outlier, lifting prices and reaffirming its status as the sector’s growth engine. Skincare tells a different story; early recalibrations at lower price points hint at a strategic attempt to broaden access to more consumers.

Color cosmetics, meanwhile, is becoming the most volatile arena: faster product cycles and deeper discounts could end up training consumers to expect constant novelty and sharper deals. For retailers, this uneven terrain demands sharper curation which means doubling down on categories with real momentum while handling softer demand with tactical promotions.

Looking ahead, beauty’s promotional future will likely not echo fashion’s race to the bottom. Instead, promotions are likely to become sharper, rarer, and more intentional: aligned with launches, exclusives, and storytelling moments designed to spark desire rather than simply clear shelves. The brands that thrive will be those that master this delicate balance, using promotions to excite, not erode.

The bigger takeaway? Beauty may still play by a different set of rules than fashion, but it is not insulated from the forces reshaping consumer behavior. Inflation, saturation, and shifting demand are pressing in. The real opportunity lies with those who can read the early signals, pivot with precision, and reinforce brand value even as the market tests their resilience.

Want to learn more about the beauty industry?

Request a demo

About Centric Software

Centric Software® (centricsoftware.com)

From its headquarters in Silicon Valley, Centric Software provides an innovative and AI-enabled product concept-to-commercialization platform for retailers, brands and manufacturers of all sizes. As experts in fashion, luxury, footwear, outdoor, home, food & beverage, cosmetics & personal care as well as multi-category retail, Centric Software delivers best-of-breed solutions to plan, design, develop, source, comply, buy, make, price, allocate, sell and replenish products.

- Centric PLM™, the leading PLM solution for fashion, outdoor, footwear and private label, optimizes product execution from ideation to development, sourcing and manufacture, realizing up to 50% improvement in productivity and a 60% decrease in time to market.

- Centric Planning™ is an innovative, cloud-native, AI solution delivering end-to-end planning capabilities to maximize retail and wholesale business performance, including SKU optimization, resulting in an up to 110% increase in margins.

- Centric Pricing & Inventory™ leverages AI to drive margins and boost revenues by up to 18% via price and inventory optimization from pre-season to in-season to season completion.

- Centric Market Intelligence™ is an AI-driven platform delivering insights into consumer trends, competitor offers and pricing to boost competitivity and get closer to the consumer, with an up to 12% increase in average initial price point.

- Centric Visual Boards™ pivot actionable data in a visual-first orientation to ensure robust, consumer-right assortments and product offers, dramatically decreasing assortment development cycle time.

- Centric PXM™, AI-powered product experience management (PXM) encompasses PIM, DAM, content syndication and digital shelf analytics (DSA) to optimize the product commercialization lifecycle resulting in a transformed brand experience. Increase sales channels, boost sell through and drive margins.

Centric Software’s market-driven solutions have the highest user adoption rate, customer satisfaction rate and fastest time to value in the industry. Centric Software has received multiple industry awards and recognition, appearing regularly in world-leading analyst reports and research.

Centric Software is a subsidiary of Dassault Systèmes (Euronext Paris: #13065, DSY.PA), the world leader in 3D design software, 3D digital mock-up and PLM solutions.

Centric Software is a registered trademark of Centric Software, Inc. in the US and other countries. Centric PLM, Centric Planning, Centric Pricing & Inventory, Centric Market Intelligence, Centric Visual Boards and Centric PXM are trademarks of Centric Software, Inc. All third-party trademarks are trademarks of their respective owners.

Explore Centric’s AI market-driven solutions

Optimize each step of bringing a product to market, whether at the pre-season, in-season or end-of-season cycle. Streamline processes, reduce costs, maximize profitability and drive sustainability.

Centric Pricing & Inventory

Centric Pricing & Inventory

Centric Market Intelligence

Centric Market Intelligence

Centric PXM

Centric PXM