Report

The Centric Market Intelligence Sneaker Market Index:

Sneaker Prices Reach Highest Levels This Decade

Average sneaker prices in March 2023 surge to record levels in the USA, rising by 12.3% since 2020 – but are followed closely by deepening retail discounts.

According to the recently released USA Sneaker Market Index data from competitor benchmarking, pricing intelligence and trend forecasting platform Centric Market Intelligence ™, sneaker prices continue to surge to record levels but also sit alongside some of the widest and deepest discounts from retailers since the pandemic.

These kinds of insights are crucial for footwear brands and retailers when strategizing pre-season or wanting to adjust their in-season promotional plan.

Centric Market Intelligence enables brands and retailers to gain a 360-degree view of the entire retail market to uncover competitors’ pricing architecture and discounting strategy.

The USA Sneaker Market Index Data - A Closer Look

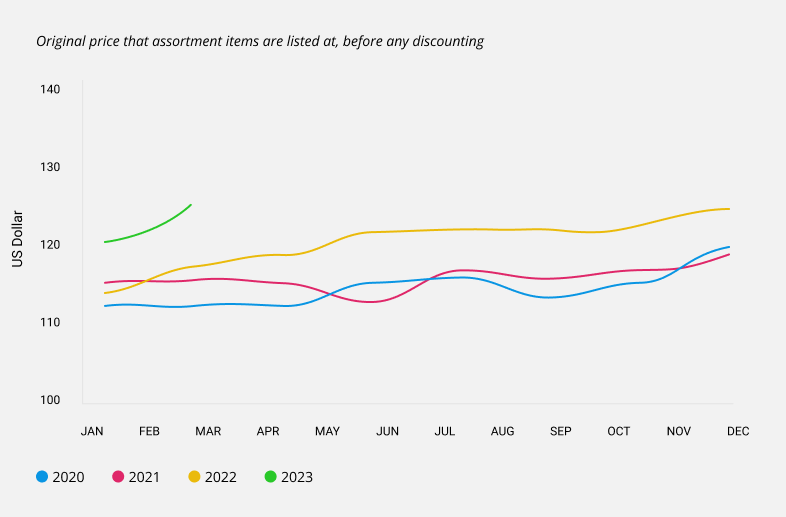

Average Original Price

Looking solely at price data for the original price point of sneakers at retail, there is a steady increase in prices from 2020 to 2023. Key takeaways include:

- Sneaker retail prices are at their highest point since January 2020, and have risen by up to 12.3% on average.

- Prices averaged $126.89 across the category in March 2023, according to the latest data.

- Significant price increases were seen during 2022, as average sneaker prices in the USA rose by 4.6%.

- Sneaker prices have risen again sharply since the beginning of 2023, already seeing a similar rise of 4.3%.

- Compared year on year, the average original price of sneakers so far in Q1 2023 is 5.9% higher than Q1 2022.

Price Increases Are Followed by Retailer Discounting

Interestingly, price increases are not aligned with greater sell-through at full price. So far, price increases across the sneaker market have run parallel with broader and deeper discounts of listed items — with these discounts reaching the highest levels recorded since the pandemic.

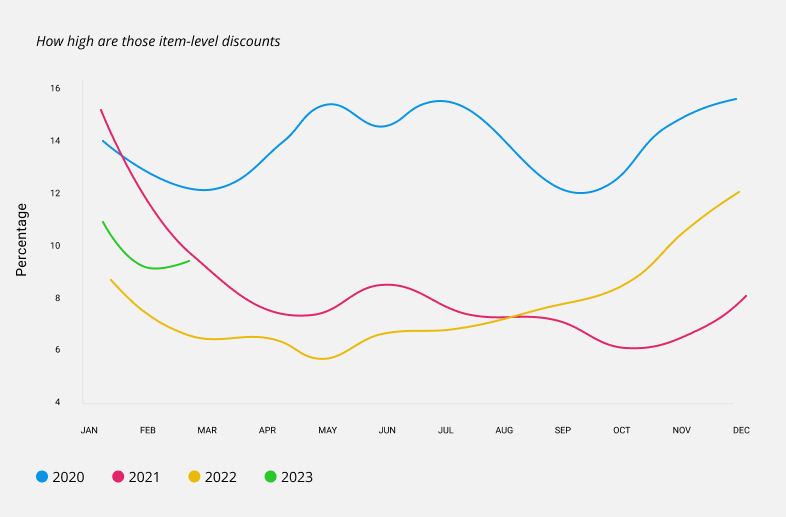

Average Discounts

So, what does the data tell us about discounting?

- Rising in line with prices, the depth of discounting in the USA sneaker market increased throughout 2022, unwinding progress made since March 2021. Discounting is currently at its highest average since March 2021.

- So far, over the last two quarters (Q4 2022 & Q1 2023), the average discount per item has increased by 42.7% year on year (compared to Q4 2021 & Q1 2022).

- So far in 2023, discounts across the sneaker market stand at an average of 9.1%.

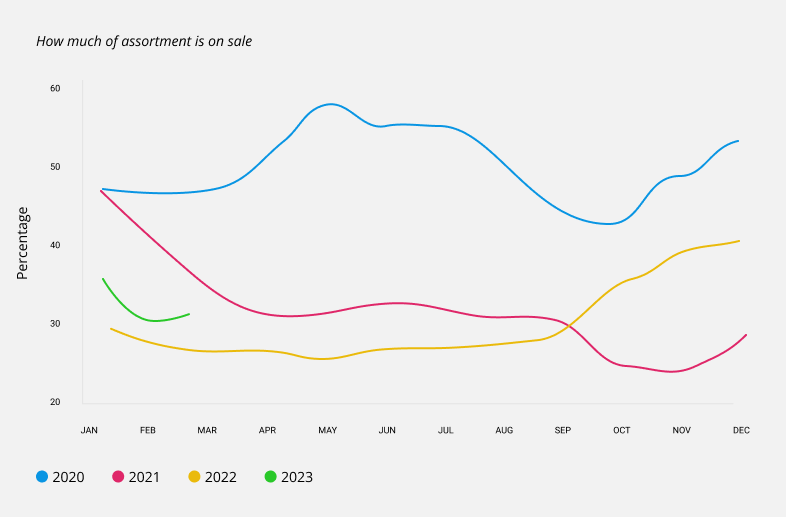

Average Discount Penetration

The range of discounting in the USA sneaker market is also broader than has been seen since the pandemic. Our discount penetration data measures how much of an assortment is on sale at a discounted price at any given time, and highlights a significant increase in levels of discounting:

- The USA sneaker market is set to see an average 29.5% increase in discount penetration over the last two quarters when compared year on year (YoY).

- So far in 2023, the discount penetration of the sneaker market stands at an average of 30.6%.

- This means that nearly a third of sneakers listed on the market in 2023 have been on sale at a discount. Over the same period in 2022 this stood at less than a quarter.

Analysis

Commenting on the USA Sneaker Market Index data, Centric Market Intelligence expert Elizabeth Shobert says,“The data throws up some interesting trends. Brands and retailers are pricing sneakers higher and higher, which is not surprising when we consider the wider context of inflation and its impact on raw material, shipping and energy costs. However, higher original prices are not being followed by sales at full price as consumers face discretionary spending pressure.”

“The breadth and depth of discounting in the USA sneaker market is noticeably increasing,” Elizabeth Shobert continues. “Brands and retailers are being pushed to drop prices in order to move aging inventory. To navigate the ongoing volatility, companies will need to do a better job at predicting trends and focus more on producing exactly the products that consumers want, and in the right amounts; planning more targeted assortments by channel and store; and using resources more efficiently to control design and production costs.”

Methodology & Data

The data for this USA Sneaker Market Index report was sourced from Centric Market Intelligence (formerly StyleSage), which gathers and analyzes vast amounts of pricing data to identify market trends and provide competitive benchmarking.

The data was last updated March, 2023, and was collected from e-commerce listings for sneaker products across the USA market.