Tariff Update: August 7, 2025

As we enter August, trade tensions for US importers continue to escalate.

As we enter August, trade tensions for US importers continue to escalate. The temporary tariff truce with China is set to expire around August 12, creating the risk that sharply higher tariffs, potentially up to 145% for some product categories, may snap back if no new deal is reached.

New tariffs on imports from the European Union, Canada, and Mexico have already taken effect, including the following highlights:

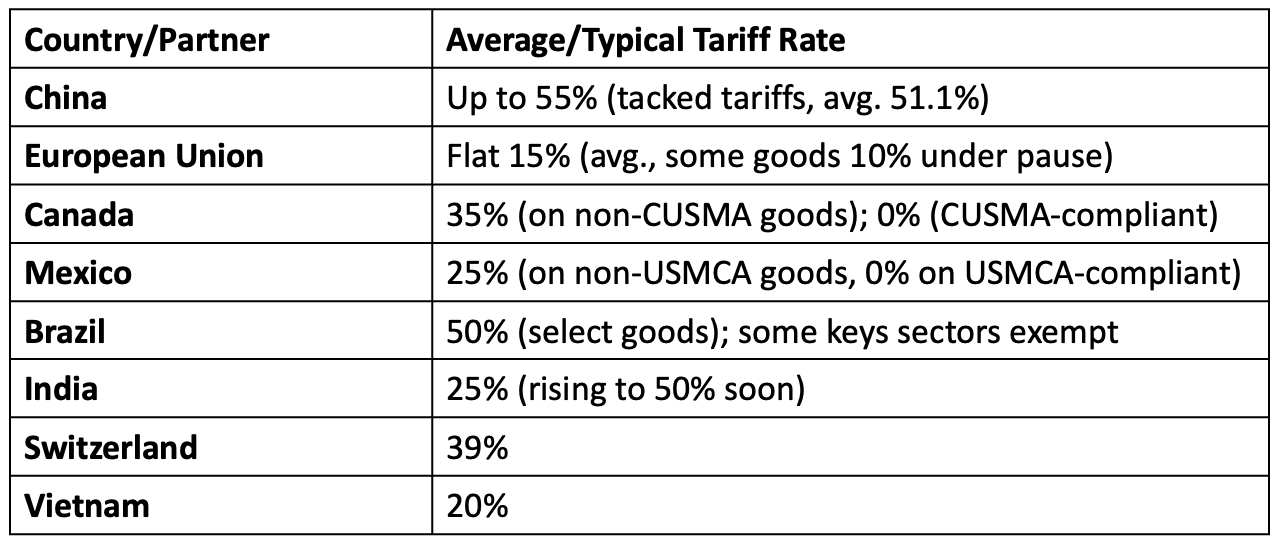

An Overview of Key Tariff Rates: August 7

While these new tariff rates have been publicly announced or negotiated, it’s important to note that these are not finalized trade agreements. Most are part of temporary arrangements or unilateral declarations and remain subject to change depending on ongoing negotiations and political developments.

Meanwhile, the US has eliminated the $800 de minimis exemption (effective August 29), exposing nearly all imports, regardless of value, to new tariffs. (More on this topic below.)

For fashion and consumer goods brands, this environment remains highly volatile. What once looked like a short-term squeeze is increasingly the new normal, placing ongoing pressure on margins, sourcing, and pricing strategies. Businesses are now navigating two simultaneous

countdowns:

- The looming end of the US-China truce, with the possibility of a return of very high

tariffs. - Recently enacted, sharply higher tariffs (often 15-35%) on imports from other major

trading partners.

Against this backdrop, agility, speed, and proactive planning are more critical than ever for brands and retailers as they face an unpredictable, rapidly shifting regulatory landscape.

Market Signals

While most retailers have yet to make bold pricing moves, subtle shifts are starting to appear.

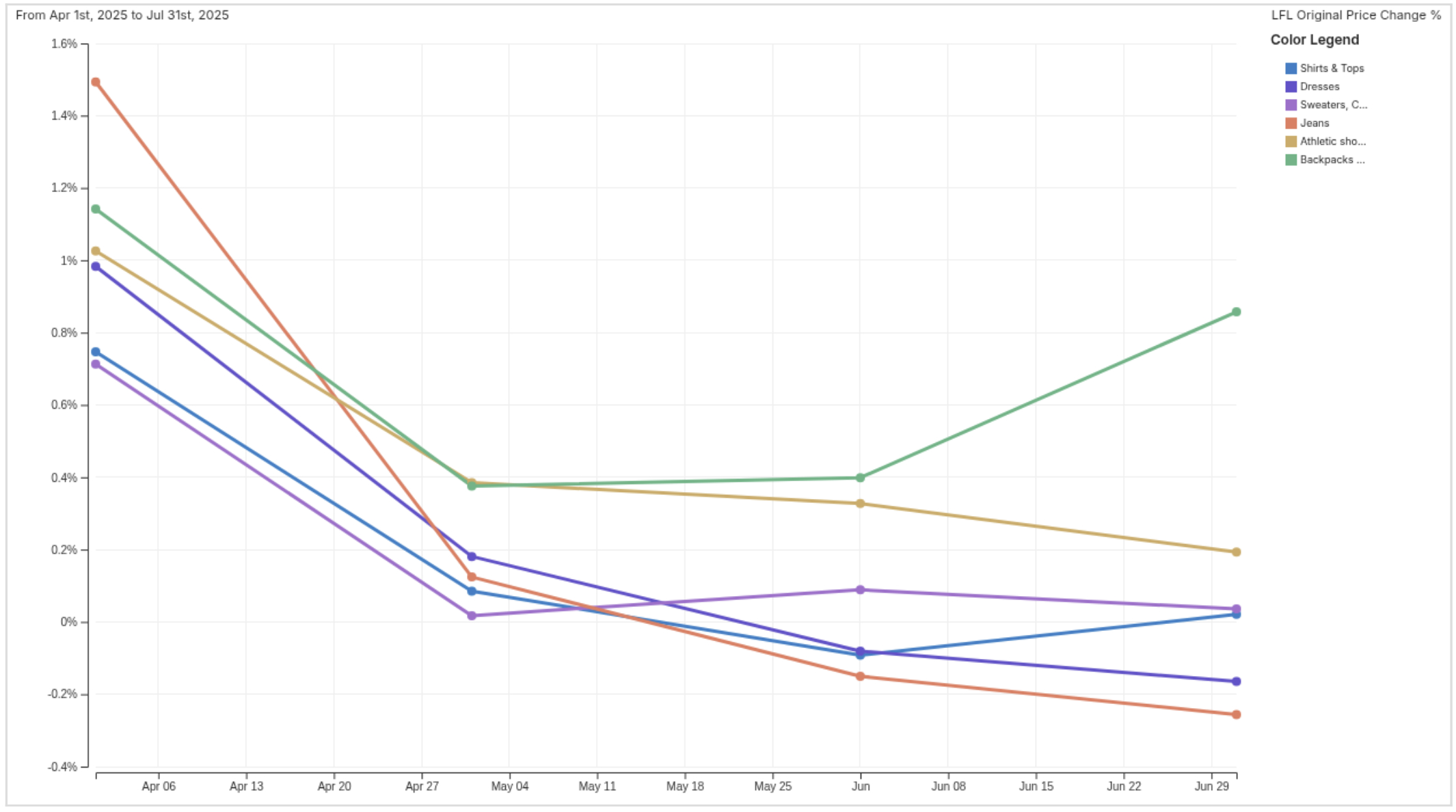

Over the past month, CMI’s Like-for-Like (LFL) Price Index has recorded only a 0.05% average increase across specialty apparel, a nearly flat trajectory that suggests brands are treading carefully as they monitor consumer sentiment and await tariff certainty. Still, there are early signs of upward pressure: backpack prices rose 0.86% in July, the largest LFL increase of any category.

LFL Price Increase % – Amongst Products available both April 1-July 31

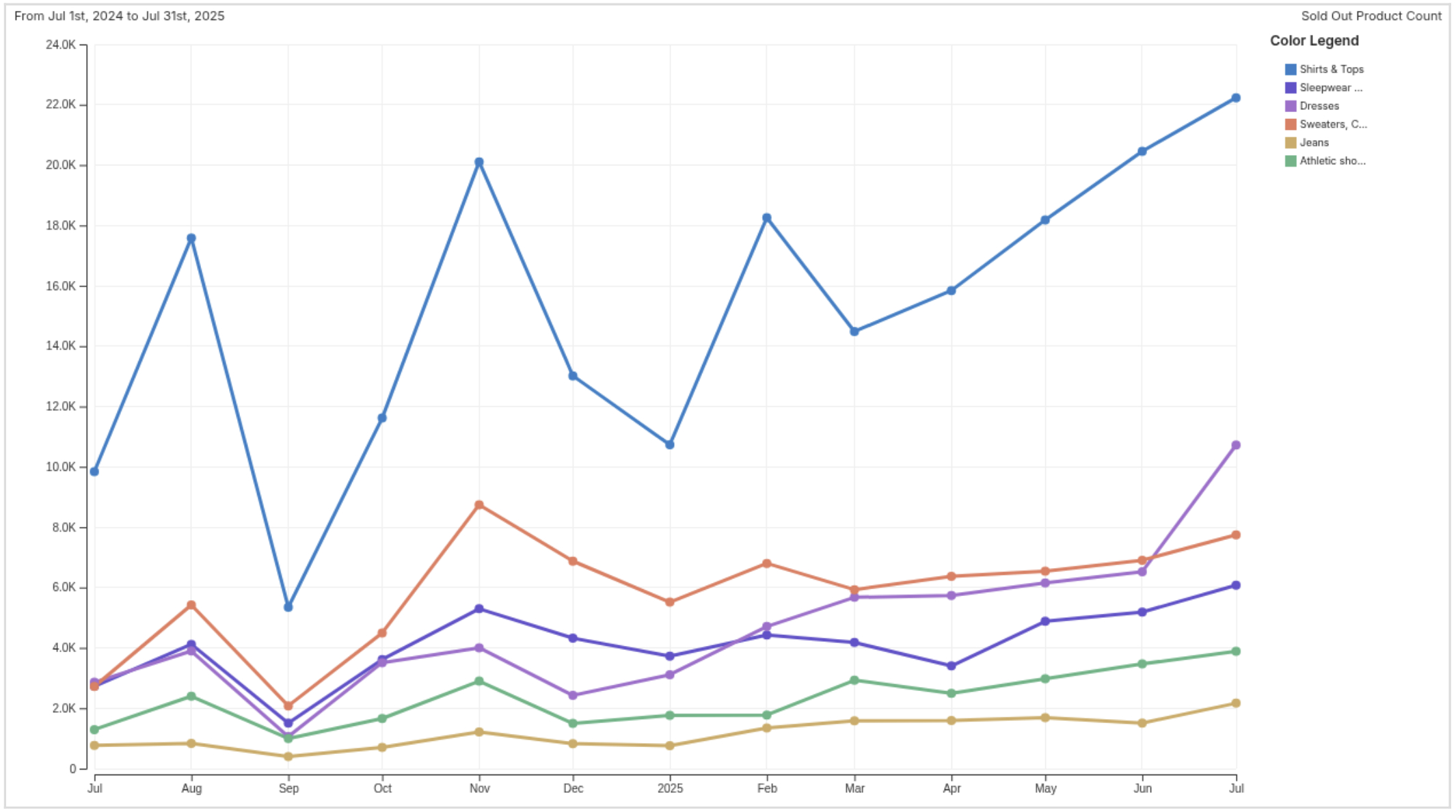

Consumers seem to be taking notice. In seasonal categories like shirts and dresses, full-price sold-out rates are tracking ahead of last year, signaling that shoppers may be buying earlier, either in anticipation of price hikes or to avoid future stockouts.

Full Price Sold Out Counts

The End of the De Minimis Loophole: A Seismic Shift for E Commerce

For years, the U.S. de minimis exemption served as a quiet engine powering the rise of cross-border e-commerce. Under this rule, imported shipments valued at $800 or less could zip through customs without tariffs or elaborate paperwork, a boon for consumers, small sellers, and international brands looking to reach U.S. shoppers directly, one package at a time.

But as of August 29, 2025, that landscape is shifting dramatically. While the Trump administration already ended the de minimis loophole for China and Hong Kong on May 2, the exemption will now close globally. This isn’t a formal trade agreement, but a unilateral regulatory change, and one that can be adjusted or reversed with little warning. With a single policy stroke, nearly all imports into the U.S., regardless of value or origin, will now be subject to full tariffs, customs declarations, and taxes. The implications for fashion, consumer goods, and cross-border e-commerce are significant, especially for brands that rely on low-value parcel shipments and DTC fulfillment models.

At the most practical level, every low-priced item arriving from abroad, whether that’s a $12 pair of socks or a $50 skincare kit, now faces a potentially hefty tariff. That could mean an added 15%, 25%, or much more on top of the sale price, depending on the country of origin.The change hits hardest at the business models that flourished under the old regime: direct-to-consumer brands, global marketplaces, and the viral drop-shippers who had mastered the art of rapid, inexpensive delivery from overseas warehouses straight to the American doorstep.

With the exemption gone, administrative costs are set to soar. Every shipment, no matter how small, requires full customs clearance. Automation and digital filing offer some relief, but the days of quick, hands-off entry, especially through programs like Entry Type 86, are history. Many e-commerce sellers and logistics providers now face a mountain of new compliance work, from accurately reporting country of origin to meeting FDA pre-entry reviews on regulated products.

For American shoppers, the new rules will be felt immediately and uncomfortably. Checkout totals will rise as duties are passed along, and the convenience of quick, cheap direct imports will give way to slower or less frequent consolidated shipments. Some low-price imports may vanish entirely, unable to absorb the tariff shock.

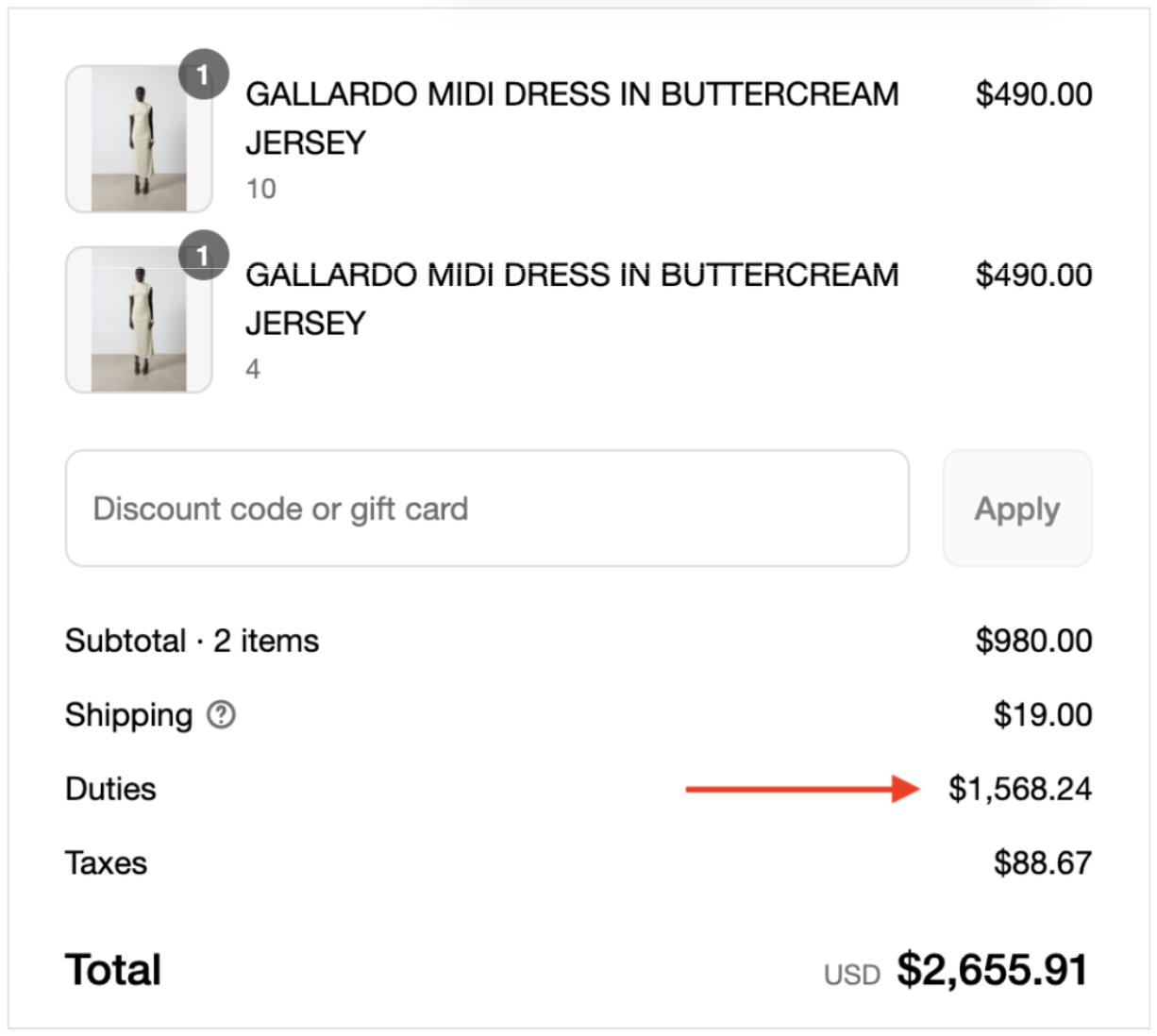

In an example we had shared in a tariff update from May, you could see directly the impact of the seller passing along the duties directly to the shopper in the following example where a 160% duty from China was levied.

Behind the scenes, a key avenue for cost-cutting, misstating value or routing goods through third countries to sidestep tariffs, is now largely closed. Transparency and compliance are the order of the day.

In theory, closing the de minimis loophole creates a fairer marketplace. Domestic brands have long argued that foreign sellers exploited the system, enjoying price and process advantages. By forcing all importers—large and small, mass and boutique—to play by the same tariff rules, the field is indeed leveled. But that new level comes at a steeper cost for every stakeholder in the supply chain.

Those thriving in the direct-to-consumer, global dropship model face urgent questions. Sourcing, pricing, logistics, and customer experience must be reimagined in this new, tariff-heavy landscape. Third-party logistics firms will need to handle vastly more customs work, potentially grappling with capacity bottlenecks and pushback on rising fees.

Most crucially, brands must decide whether to absorb these new costs or pass them along to shoppers—who may be less forgiving and more price-sensitive than ever.

The end of the de minimis exemption doesn’t just tweak the math on imports. It signals a new chapter in the story of U.S. trade: one where agility and compliance are as vital to success as style and speed.

Strategic Considerations for Brands & Retailers

- Plan for Real Volatility: Tariffs at these levels are no longer theoretical. Businesses must operate under the assumption that 145%+ on China and 30%+ across key trade partners could remain in place for months. Scenario planning should be active, cross-functional, and regularly updated.

- Be Strategic With Pricing: Avoid raising prices on core or carryover products where price sensitivity and repeat purchase behavior are highest. Instead, use newness and capsule collections as testing grounds for pricing elasticity and margin expansion.

- Reevaluate De Minimis Reliance: De minimis imports from China now carry a 54% tariff or a flat $100 fee — severely limiting their advantage. Brands relying on small parcel fulfillment for DTC should consider consolidated shipments or alternate regional hubs.

- Watch the Market, Not Just the Policy: Tools like CMI’s Product Split View and LFL Price Change % allow teams to monitor item and category shifts and competitor moves in near real time. In this climate, when you move is as important as how you move.

What to Watch Next

- Will the tariff deadline on Chinese imports be extended beyond August 14, and where willthey land?

- Will tensions with the EU escalate, pushing tariffs even higher in September?

- Will new trade partners (e.g., Vietnam, India) be targeted next and if so, to what extent?

- How will pricing behavior shift post-August 15 as brands reassess strategies?

The tariff environment is now a permanent fixture of the retail landscape, not a temporary disruption. Brands that respond proactively, with clear contingency planning and nimble

pricing strategies, will be best positioned to protect margins and preserve consumer trust.

The next few weeks will be pivotal. We’ll continue monitoring the data and will share updated insights as the situation evolves.

To track ongoing price and product shifts in your category and competitive set, visit our Tariff Watch Dashboard.

Want to learn more about tariffs?

Request a demo

About Centric Software

Centric Software® (centricsoftware.com)

From its headquarters in Silicon Valley, Centric Software provides an innovative and AI-enabled product concept-to-commercialization platform for retailers, brands and manufacturers of all sizes. As experts in fashion, luxury, footwear, outdoor, home, food & beverage, cosmetics & personal care as well as multi-category retail, Centric Software delivers best-of-breed solutions to plan, design, develop, source, comply, buy, make, price, allocate, sell and replenish products.

- Centric PLM™, the leading PLM solution for fashion, outdoor, footwear and private label, optimizes product execution from ideation to development, sourcing and manufacture, realizing up to 50% improvement in productivity and a 60% decrease in time to market.

- Centric Planning™ is an innovative, cloud-native, AI solution delivering end-to-end planning capabilities to maximize retail and wholesale business performance, including SKU optimization, resulting in an up to 110% increase in margins.

- Centric Pricing & Inventory™ leverages AI to drive margins and boost revenues by up to 18% via price and inventory optimization from pre-season to in-season to season completion.

- Centric Market Intelligence™ is an AI-driven platform delivering insights into consumer trends, competitor offers and pricing to boost competitivity and get closer to the consumer, with an up to 12% increase in average initial price point.

- Centric Visual Boards™ pivot actionable data in a visual-first orientation to ensure robust, consumer-right assortments and product offers, dramatically decreasing assortment development cycle time.

- Centric PXM™, AI-powered product experience management (PXM) encompasses PIM, DAM, content syndication and digital shelf analytics (DSA) to optimize the product commercialization lifecycle resulting in a transformed brand experience. Increase sales channels, boost sell through and drive margins.

Centric Software’s market-driven solutions have the highest user adoption rate, customer satisfaction rate and fastest time to value in the industry. Centric Software has received multiple industry awards and recognition, appearing regularly in world-leading analyst reports and research.

Centric Software is a subsidiary of Dassault Systèmes (Euronext Paris: #13065, DSY.PA), the world leader in 3D design software, 3D digital mock-up and PLM solutions.

Centric Software is a registered trademark of Centric Software, Inc. in the US and other countries. Centric PLM, Centric Planning, Centric Pricing & Inventory, Centric Market Intelligence, Centric Visual Boards and Centric PXM are trademarks of Centric Software, Inc. All third-party trademarks are trademarks of their respective owners.

Explore Centric’s AI market-driven solutions

Optimize each step of bringing a product to market, whether at the pre-season, in-season or end-of-season cycle. Streamline processes, reduce costs, maximize profitability and drive sustainability.