Tariff Update: The Latest Price Increase Data

Price increases are happening in fashion, but spoiler alert, they’re far more modest than you might expect.

Price increases are happening in fashion, but spoiler alert, they’re far more modest than you might expect.

We dug into US market pricing data, using a cross-section of specialty retailers and department stores, to examine the extent to which fashion categories are seeing price growth.

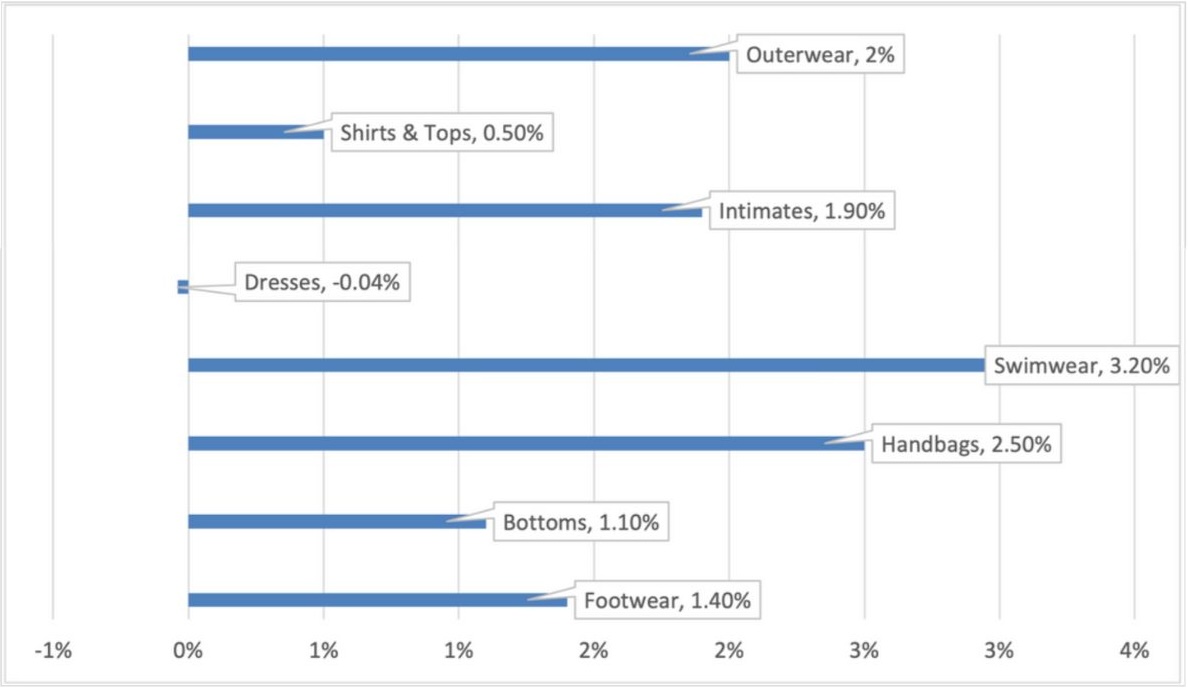

Looking at October 2024 vs. October 2025 shows that average original prices across most apparel categories have risen only marginally YOY, in most cases, by less than 2%. Using our historic timeline filters, we were able to isolate products available both at the beginning and end of our timeframe to best narrow in on price increases for the same items and to remove the noise of new product introductions and mix shifts. Let’s take a closer look at what we found:

In reality, while retailers have nudged some ticket prices higher, those increases have been pretty modest. It’s less a case of runaway inflation and more about careful adjustments.

Moreover, it’s a sign that shoppers are still price-sensitive and that promotions continue to shape the competitive landscape.

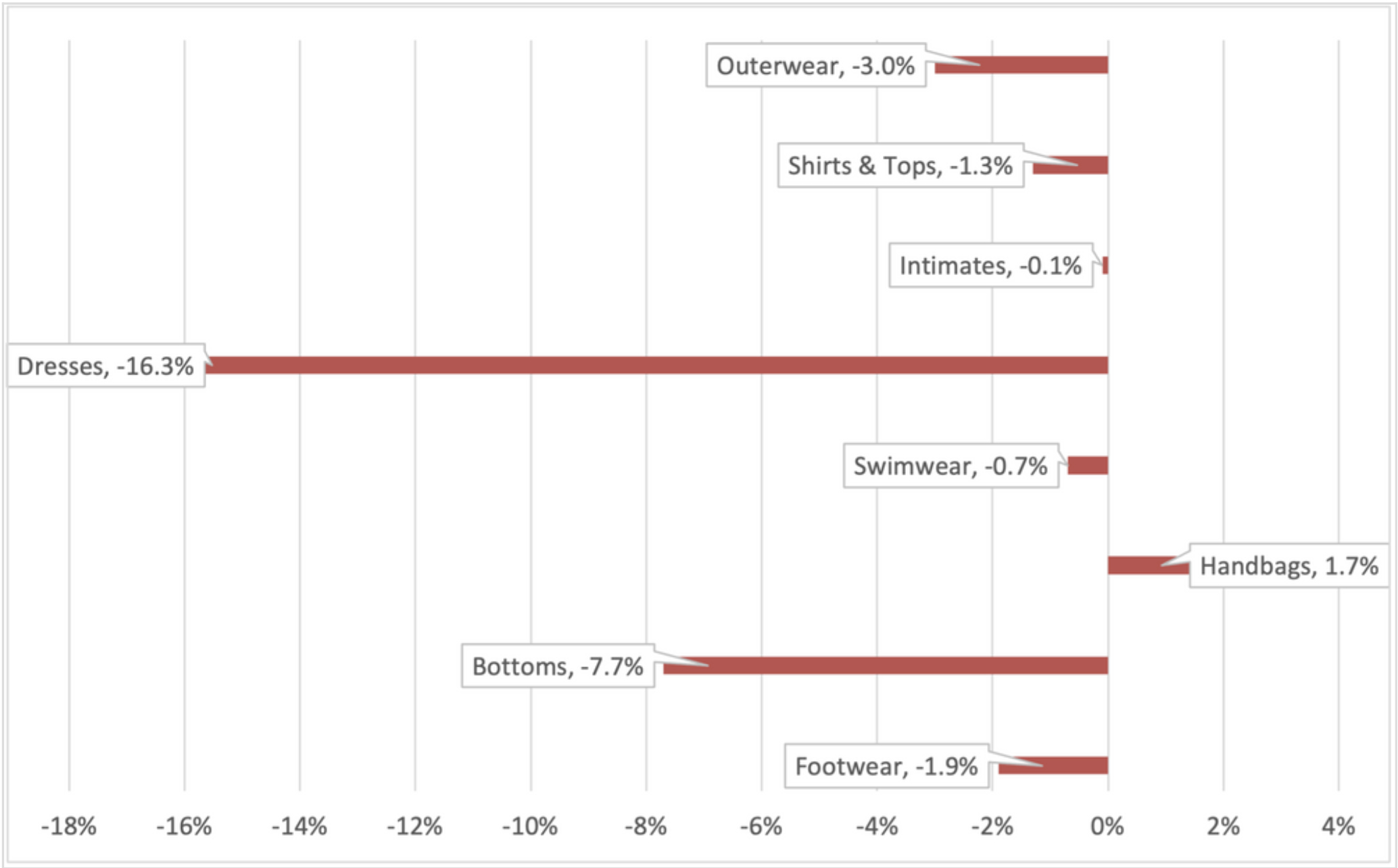

Once you bring new products into the picture, things get even more interesting. Looking across total assortments, including all the fresh SKUs that landed this year, average prices in several categories have actually dipped. That points to a deliberate strategy by some retailers to introduce lower-priced items to keep assortments feeling accessible and conversion-friendly.

Average YOY Original Price Increase: Products Available Beginning and End of Timeframe

The big outlier? Handbags. Both views on pricing show that these are way up, likely reflecting stronger brand equity and pricing power and tighter promotional control. It’s one of the few categories where retailers seem to believe that consumers are willing to absorb higher prices.

Average YOY Original Price Increase: All Products

But when you zoom in on what’s really happening at checkout, after discounts are applied, the story flips. Across most categories (handbags aside), average current prices, so those inclusive of markdowns and discounts, have actually fallen year over year. That tells us that while list prices may inch up, retailers are still leaning heavily on markdowns and promotions to move product.

In other words, price tags are creeping up, but sell-through still depends on a well-timed discount. It’s a balancing act: protecting margins while staying competitive and keeping demand steady.

Average YOY Current Price Increase: Products Available Beginning and End of Timeframe

For merchandisers and buyers, the takeaways are clear:

- Yes, price inflation is real, but as of right now, it’s controlled.

- Promotional strategies are still doing the heavy lifting when it comes to getting

consumers over the line. - New product introductions are skewing assortments toward more value-oriented price

points in several categories.

In other words, despite headlines about inflation and cost pressures, retail pricing strategies still remain measured, with the real story happening below the ticket price, in discount depth, mix management, and promotional cadence.

Watch this space as we continue to report on price changes and tariff news. To learn about how to conduct your own price increase analysis and stay ahead, get in touch or request a demo.

Want to learn more about tariffs?

Request a demo

About Centric Software

Centric Software® (centricsoftware.com)

From its headquarters in Silicon Valley, Centric Software provides an innovative and AI-enabled product concept-to-commercialization platform for retailers, brands and manufacturers of all sizes. As experts in fashion, luxury, footwear, outdoor, home, cosmetics & personal care as well as multi-category retail, Centric Software delivers best-of-breed solutions to plan, design, develop, source, comply, buy, make, price, allocate, sell and replenish products.

- Centric PLM™, the leading PLM solution for fashion, outdoor, footwear and private label, optimizes product execution from ideation to development, sourcing and manufacture, realizing up to 50% improvement in productivity and a 60% decrease in time to market.

- Centric Planning™ is an innovative, cloud-native, AI solution delivering end-to-end planning capabilities to maximize retail and wholesale business performance, including SKU optimization, resulting in an up to 110% increase in margins.

- Centric Pricing & Inventory™ leverages AI to drive margins and boost revenues by up to 18% via price and inventory optimization from pre-season to in-season to season completion.

- Centric Market Intelligence™ is an AI-driven platform delivering insights into consumer trends, competitor offers and pricing to boost competitivity and get closer to the consumer, driving up to a 12% increase in average initial price point.

- Centric Visual Boards™ pivot actionable data in a visual-first orientation to ensure robust, consumer-right assortments and product offers, dramatically decreasing assortment development cycle time.

- Centric PXM™, AI-powered product experience management (PXM) encompasses PIM, DAM, content syndication and digital shelf analytics (DSA) to optimize the product commercialization lifecycle resulting in a transformed brand experience. Increase sales channels, boost sell through and drive margins.

Centric Software’s market-driven solutions have the highest user adoption rate, customer satisfaction rate and fastest time to value in the industry. Centric Software has received multiple industry awards and recognition, appearing regularly in world-leading analyst reports and research.

Centric Software is a subsidiary of Dassault Systèmes (Euronext Paris: #13065, DSY.PA), the world leader in 3D design software, 3D digital mock-up and PLM solutions.

Centric Software is a registered trademark of Centric Software, Inc. in the US and other countries. Centric PLM, Centric Planning, Centric Pricing & Inventory, Centric Market Intelligence, Centric Visual Boards, Centric PXM, Centric PIM, Centric DAM, Centric Shoppingfeed® and Centric DSA (including Centric Digital Shelf Analytics) are trademarks of Centric Software, Inc. All third-party trademarks are trademarks of their respective owners.

Explore Centric’s AI market-driven solutions

Optimize each step of bringing a product to market, whether at the pre-season, in-season or end-of-season cycle. Streamline processes, reduce costs, maximize profitability and drive sustainability.

Centric Pricing & Inventory

Centric Pricing & Inventory

Centric Market Intelligence

Centric Market Intelligence

Centric PXM

Centric PXM