How Brands & Retailers Should Prepare For The Holiday Season Ahead

Ah, the holidays.

Ah, the holidays. That magical time of year when consumers turn into deal-hunting ninjas, retailers pull out all the stops, and brands either end the year with a bang or a whimper. For retailers, the holiday season isn’t just about string lights and that festive feeling; it’s make-or- break for the bottom line.

But here’s the catch: this year’s holiday shopping landscape is shaping up to be anything but traditional. Economic uncertainty is swirling, global trade policies are shifting (hello, tariffs), and consumer moods are… well, let’s just say “complicated.” One day they’re splurging on luxury skincare, the next they’re Googling “lowest-price designer dupe handbag.”

So, what’s a brand to do? The smart move is to prep now with a healthy dose of market intelligence because guessing games are not a holiday strategy.

The Global Market Landscape

On a global scale, retail performance presents a mixed picture: certain regions are posting steady growth, while others are grappling with economic headwinds.

In the U.S., shoppers are still showing up, carts in hand, but they’re doing it with a sharper pencil. Inflation and higher interest rates have everyone double-checking receipts, which means the days of “toss it in the cart and figure it out later” are behind us. Americans are still spending, but they’re pickier, delaying big-ticket buys and gravitating toward discounts like moths to a flame.

What’s even more telling is who’s doing the spending in the U.S. Increasingly, it’s the top earners carrying the load. In Q2, the top 10% of households accounted for half of all consumer spending, the highest share since 1989. That concentration underscores a growing divide: the holiday season may look very different depending on which end of the income ladder your target consumer occupies.

Over in Europe, the mood is a little more subdued. Rising energy costs, the ongoing Russia- Ukraine war, and continued economic jitters have shoppers holding onto their wallets with both hands. That said, the right deal can still pry them open: think promotions that feel like smart moves rather than splurges. The appetite for luxury hasn’t completely disappeared, but it’s tempered with a dose of cautious realism.

Meanwhile, Asia is playing a more dynamic tune. China’s Singles Day remains a retail juggernaut, but consumer confidence there has been wobbling, which makes predicting spend a tricky business. On the flip side, Southeast Asia is buzzing with growth in e-commerce, with younger, digital-native consumers driving momentum. Brands that tailor their playbooks to these local dynamics are going to be the ones who come out on top.

The lesson is simple: there’s no copy-and-paste strategy for the holidays. Ignore local nuances, and even the best-laid plans can unravel.

Consumer Sentiment and Behavior Shifts

Now, let’s talk about the star of the show: consumers. Their behavior is changing faster than you can say “doorbuster deal.”

First up: value is king. Shoppers are stretching their budgets and looking for ways to make every purchase go further. In fashion and beauty, that often means paying closer attention to promotions, limited-time bundles, and loyalty rewards that add tangible value. Whether it’s a gift-with-purchase on a fragrance set or bonus points toward a future handbag, customers are more inclined to engage with brands that make their money work harder and less forgiving of those that don’t.

Consumers are also trading down, even those with plenty of disposable income. What matters isn’t just what they can afford, but what feels like the smarter buy. That might mean shifting from luxury to approachable luxury, or from mid-tier to value and off-price. For retailers, the implication is clear: having a thoughtful mix of price points is essential to capture shoppers across these different value mindsets.

Then there’s the convenience factor. Consumers have been spoiled by one-click ordering, same-day delivery, and painless returns, and there’s no going back. Convenience has shifted from “nice-to-have” to “non-negotiable.” A brand that makes customers jump through hoops to buy or return a product will be ghosted faster than you can say “abandoned cart.”

And here’s where it gets interesting: shoppers aren’t just bargain-hunting, they’re also chasing affordable luxuries. Think “treats, but within reach.” Our data shows searches for Coach bags are up 50%, while Gucci searches are down 8%. The signal is clear: consumers want a taste of aspiration, but they’re gravitating toward brands that balance prestige with attainability.

Here’s the kicker: consumer moods are swinging like a holiday pendulum. Surveys show people feel economically squeezed, yet they’re still willing to splurge when the right product hits the right emotional note at the right price. Translation: don’t underestimate their caution, but don’t underestimate their appetite for little luxuries either.

Tariffs, Trade Policy, and Supply Chain Risks

Now, let’s talk about the elephant in the global warehouse: tariffs and trade policy. Nothing kills holiday cheer quite like a surprise cost hike on the goods you were banking on to drive sales. Global supply chains are already a game of Jenga; add in shifting tariffs and suddenly that tower looks a little wobbly.

Take the U.S.-China dynamic, for example: import duties can flip margin calculations overnight, turning a “sure thing” product line into a far less profitable one. In Europe, shifting trade rules and new paperwork requirements are adding costs that retailers may struggle to absorb without passing them on to consumers. At the same time, shoppers who once ordered freely from overseas are increasingly deterred by extra fees, opting instead for products sourced closer to home, a shift that creates both opportunities and risks, depending on which side of that equation you’re on. And then there’s the currency factor: few things add holiday stress faster than watching a weak dollar or euro quietly inflate sourcing costs.

So how do smart retailers prepare? For starters, by hedging their bets. That means diversifying suppliers, exploring nearshoring options, and building in a little wiggle room on inventory. Nobody wants to be the brand explaining to a customer that their order won’t arrive until Valentine’s Day because it’s stuck in customs. And if higher costs are inevitable, retailers need to get creative, either by baking them into dynamic pricing strategies or being transparent enough with consumers to keep their trust intact.

Tariffs and trade policy may be well outside your control, but how you plan for them isn’t. Brands that treat supply chain resilience as a holiday must-have, not an afterthought, will be the ones still standing when the dust (and wrapping paper) settles.

What The Latest Market Data Tells Us

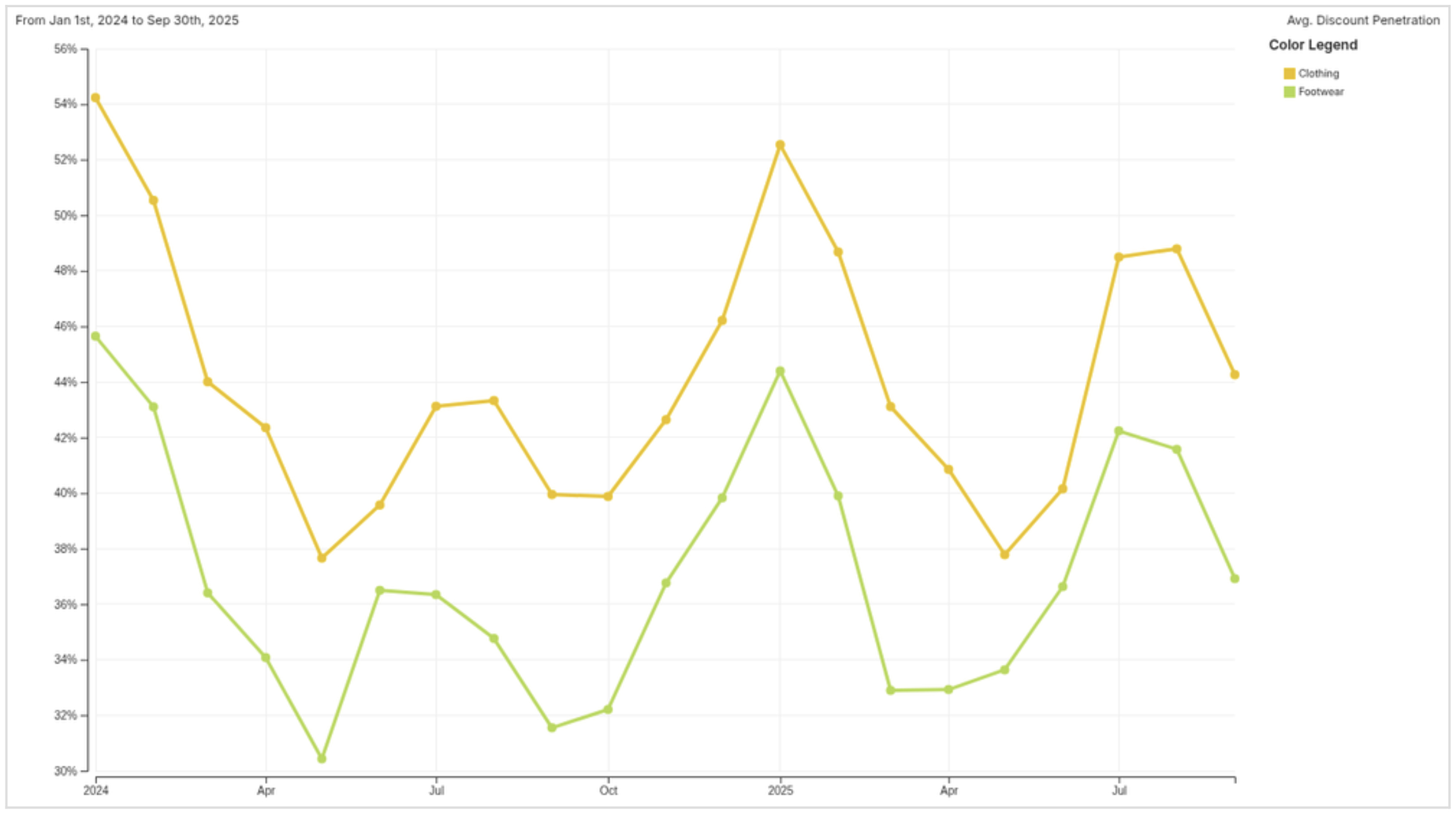

If there’s one thing consumers love more than holiday cookies, it’s a good deal, but this year, the story is more complicated. In the U.S., discounting has actually pulled back year-over- year in both apparel and footwear. Rather than rushing into deeper markdowns, retailers are showing restraint. Promotions are still on the calendar, but they’re shorter, sharper, and more targeted instead of sprawling “Black Friday in October” marathons.

Monthly Average Discount Penetration U.S. Market

Contrast that with the UK, where discounting is trending higher year-over-year heading into peak season. The divergence underscores a crucial point: holiday strategies cannot be copy-and-pasted across markets. What works in London may not resonate in Los Angeles, and retailers that ignore these nuances risk losing ground.

Monthly Average Discount Penetration UK Market

Overlaying this is another shift: in the U.S., price increases are gaining momentum. Between June and September, the number of price hikes jumped more than 300%, a clear signal that retailers are testing just how much pricing power their brands still hold. In categories with strong brand equity, like prestige beauty or luxury accessories, price increases are sticking. In more price-sensitive segments, however, retailers are moving carefully to avoid backlash.

Discounting and pricing aren’t all-or-nothing moves anymore. They’re about nuance.

The smartest retailers are holding back markdowns where products are selling, testing price bumps where the brand can carry it, and tweaking the approach market by market. Miss that balance, and you either give away margin or lose your customer’s trust.

Strategic Takeaways for Brands & Retailers

Alright, let’s bring this holiday playbook into focus. If there’s one lesson from the swirl of consumer sentiment, tariff drama, and discounting free-for-all, it’s this: agility wins. Brands and retailers that can read the room, globally, locally, and sometimes by the hour, will come out ahead.

First, listen to the data in real time. Promotions don’t need to be locked in stone weeks ahead; they should be able to flex based on how shoppers are responding. If a category isn’t moving, test sharper entry price points or shorten promo windows. If searches spike for a particular style or brand, be ready to lean into that momentum fast.

Second, adjust pricing plays with precision. Blanket discounts are giving way to more surgical strategies: shorter bursts, targeted offers, and selective price increases where brand equity can carry them. That combination of restraint and opportunism helps protect margins while still keeping customers engaged.

Third, dial up omni-channel touchpoints. Convenience has become the great differentiator, and retailers can win in-season by tightening the nuts and bolts: faster click-and-collect, smoother returns, smarter recommendations. Shoppers won’t forgive clunky checkout flows or delivery delays when competitors are only a click away.

And finally, nurture loyalty in the moment. Consumers are choosier than ever, but they’re also looking for small luxuries that feel rewarding. Brands that reinforce trust, whether through transparent pricing, member-only perks, or personalized offers, will keep shoppers coming back long after the wrapping paper is gone.

The holidays may be about tradition, but for retailers, this season is all about adaptation. Economic headwinds, global trade tensions, and ever-savvier shoppers mean the old playbooks don’t cut it anymore. The brands that thrive will be those that stay nimble, leverage market intelligence like a secret weapon, and put consumers, their quirks, their caution, and yes, their love of a bargain, front and center.

In other words: don’t just hope for holiday magic. Make it.

Want to learn more?

Contact us

About Centric Software

Centric Software® (centricsoftware.com)

From its headquarters in Silicon Valley, Centric Software provides an innovative and AI-enabled product concept-to-commercialization platform for retailers, brands and manufacturers of all sizes. As experts in fashion, luxury, footwear, outdoor, home, food & beverage, cosmetics & personal care as well as multi-category retail, Centric Software delivers best-of-breed solutions to plan, design, develop, source, comply, buy, make, price, allocate, sell and replenish products.

- Centric PLM™, the leading PLM solution for fashion, outdoor, footwear and private label, optimizes product execution from ideation to development, sourcing and manufacture, realizing up to 50% improvement in productivity and a 60% decrease in time to market.

- Centric Planning™ is an innovative, cloud-native, AI solution delivering end-to-end planning capabilities to maximize retail and wholesale business performance, including SKU optimization, resulting in an up to 110% increase in margins.

- Centric Pricing & Inventory™ leverages AI to drive margins and boost revenues by up to 18% via price and inventory optimization from pre-season to in-season to season completion.

- Centric Market Intelligence™ is an AI-driven platform delivering insights into consumer trends, competitor offers and pricing to boost competitivity and get closer to the consumer, with an up to 12% increase in average initial price point.

- Centric Visual Boards™ pivot actionable data in a visual-first orientation to ensure robust, consumer-right assortments and product offers, dramatically decreasing assortment development cycle time.

- Centric PXM™, AI-powered product experience management (PXM) encompasses PIM, DAM, content syndication and digital shelf analytics (DSA) to optimize the product commercialization lifecycle resulting in a transformed brand experience. Increase sales channels, boost sell through and drive margins.

Centric Software’s market-driven solutions have the highest user adoption rate, customer satisfaction rate and fastest time to value in the industry. Centric Software has received multiple industry awards and recognition, appearing regularly in world-leading analyst reports and research.

Centric Software is a subsidiary of Dassault Systèmes (Euronext Paris: #13065, DSY.PA), the world leader in 3D design software, 3D digital mock-up and PLM solutions.

Centric Software is a registered trademark of Centric Software, Inc. in the US and other countries. Centric PLM, Centric Planning, Centric Pricing & Inventory, Centric Market Intelligence, Centric Visual Boards and Centric PXM are trademarks of Centric Software, Inc. All third-party trademarks are trademarks of their respective owners.

Discover More

Explore Centric’s AI market-driven solutions

Optimize each step of bringing a product to market, whether at the pre-season, in-season or end-of-season cycle. Streamline processes, reduce costs, maximize profitability and drive sustainability.